The importance of asset allocation is difficult to overstate. The landmark Brinson, Hood, and Beebower study famously demonstrated that this policy determines over 90% of a portfolio's return variability.[1] It is, in essence, the architectural blueprint for wealth growth and preservation.

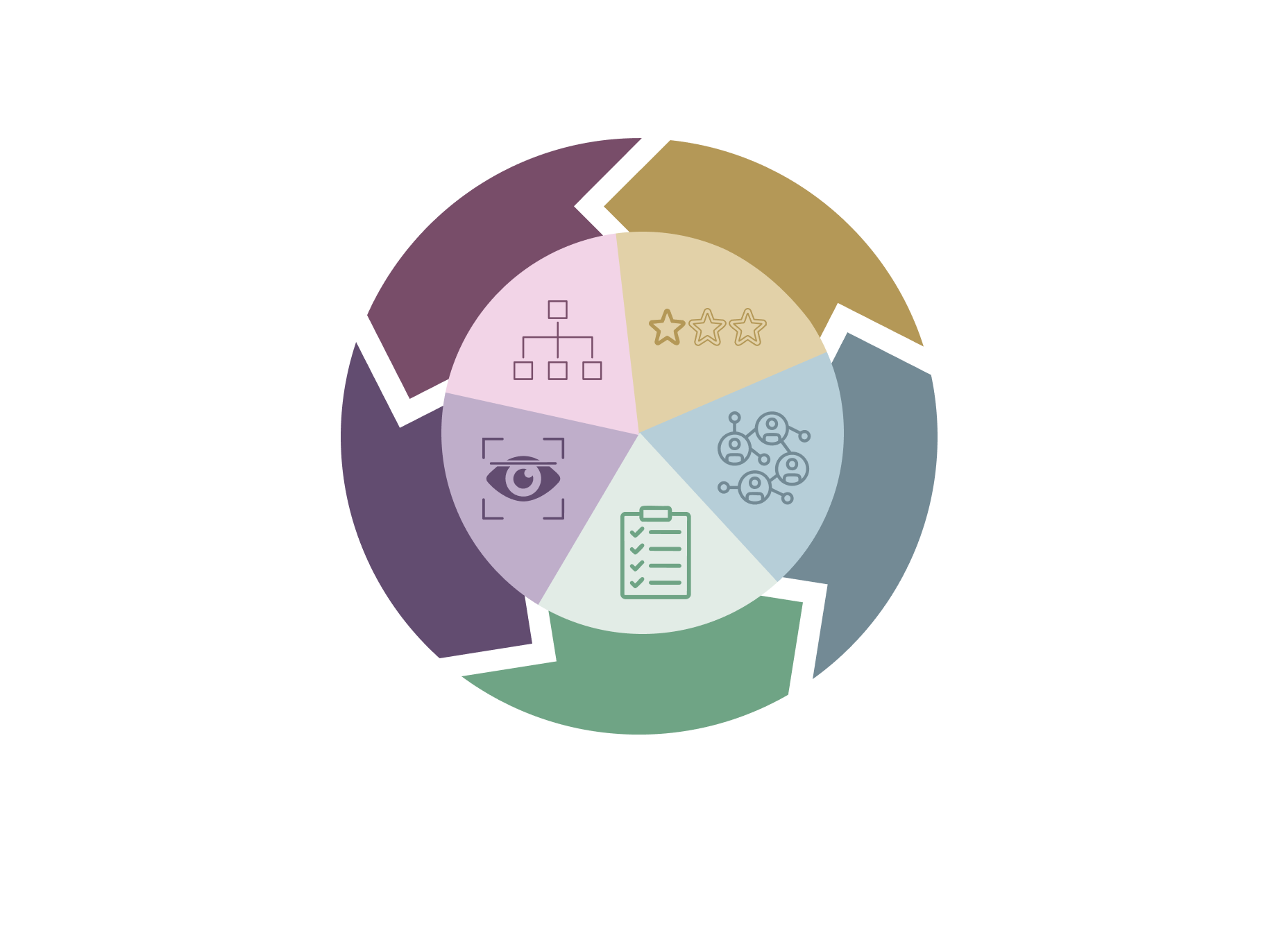

However, a blueprint alone has never built a lasting structure. Its potential is only realized through execution. For many investors, the power of asset allocation remains a purely theoretical concept because they lack the critical ingredients to bring it to life. The difference between a plan on paper and a resilient, performing portfolio lies in the discipline and capability of its execution. To truly capture the power of asset allocation, investors must master five essential execution ingredients.

1. Diversified, Top-Quartile Manager Selection

1. Diversified, Top-Quartile Manager Selection

Identifying investment managers who can consistently deliver top-quartile performance is a rigorous, full-time endeavour. It requires exhaustive due diligence that scrutinizes not just past returns, but investment processes, operational integrity, and team dynamics. An institutional approach avoids concentrating risk with a single manager in any given area, instead building a diversified roster of specialists who collectively strengthen the portfolio.

2. Access to High-Quality, Differentiated Deals

An institutional approach to asset allocation extends far beyond a simple mix of public stocks and bonds. True diversification and enhanced returns are often found in private markets: private equity, venture capital, real estate, and private credit. The best-performing opportunities in these areas are rarely advertised, they are sourced through deep networks, trusted relationships, and a reputation for being a value-added partner. Access is the first, and often highest, barrier to entry.

3. Proactive Liquidity Planning

Investing in illiquid private markets offers the potential for superior returns, but it comes at the cost of tying up capital for extended periods. Without meticulous liquidity planning, this can become a critical vulnerability. An execution-focused strategy involves carefully forecasting the investor’s short and long-term cash needs for lifestyle, taxes, philanthropy, or new ventures. This forecast is then mapped against the capital call schedules and distribution timelines of the investment portfolio to ensure cash is always available when needed.

4. Active Oversight and Dynamic Management

An asset allocation policy is not a "set-it-and-forget-it" document. It requires constant, active oversight. This includes the discipline to rebalance the portfolio such as systematically trimming assets that have outperformed and adding to those that have lagged to remain true to the long-term targets. It also involves continuous monitoring of managers and, where appropriate, making tactical adjustments to capitalize on market dislocations or mitigate emerging risks. This active management ensures the portfolio remains aligned with both the investor’s strategic goals and the evolving economic landscape.

5. A Holistic Risk Management Framework

Risk management in an institutional context is more than just diversification. It involves a sophisticated, 360-degree view of potential threats. This means stress-testing the portfolio against various macroeconomic scenarios, understanding the hidden correlations between assets that emerge during crises, and managing non-financial risks such as counterparty and operational vulnerabilities. It is a proactive discipline focused on identifying what could go wrong and implementing structures to protect capital before it does.

In conclusion, while a well-defined asset allocation plan is the necessary starting point, it is the integrated execution of these five ingredients that unlocks its true value. This continuous cycle of access, selection, risk management, planning, and oversight requires scale, deep expertise, and unwavering dedication. For investors seeking to ensure their blueprint for wealth stands the test of time, the most important question is not simply "What is our asset allocation?" but "Do we have the institutional capability to execute it effectively?"

If you’d like to learn more, please contact your Relationship Manager.

[1] Brinson Et Al. (1986) - Determinants of Portfolio Performance