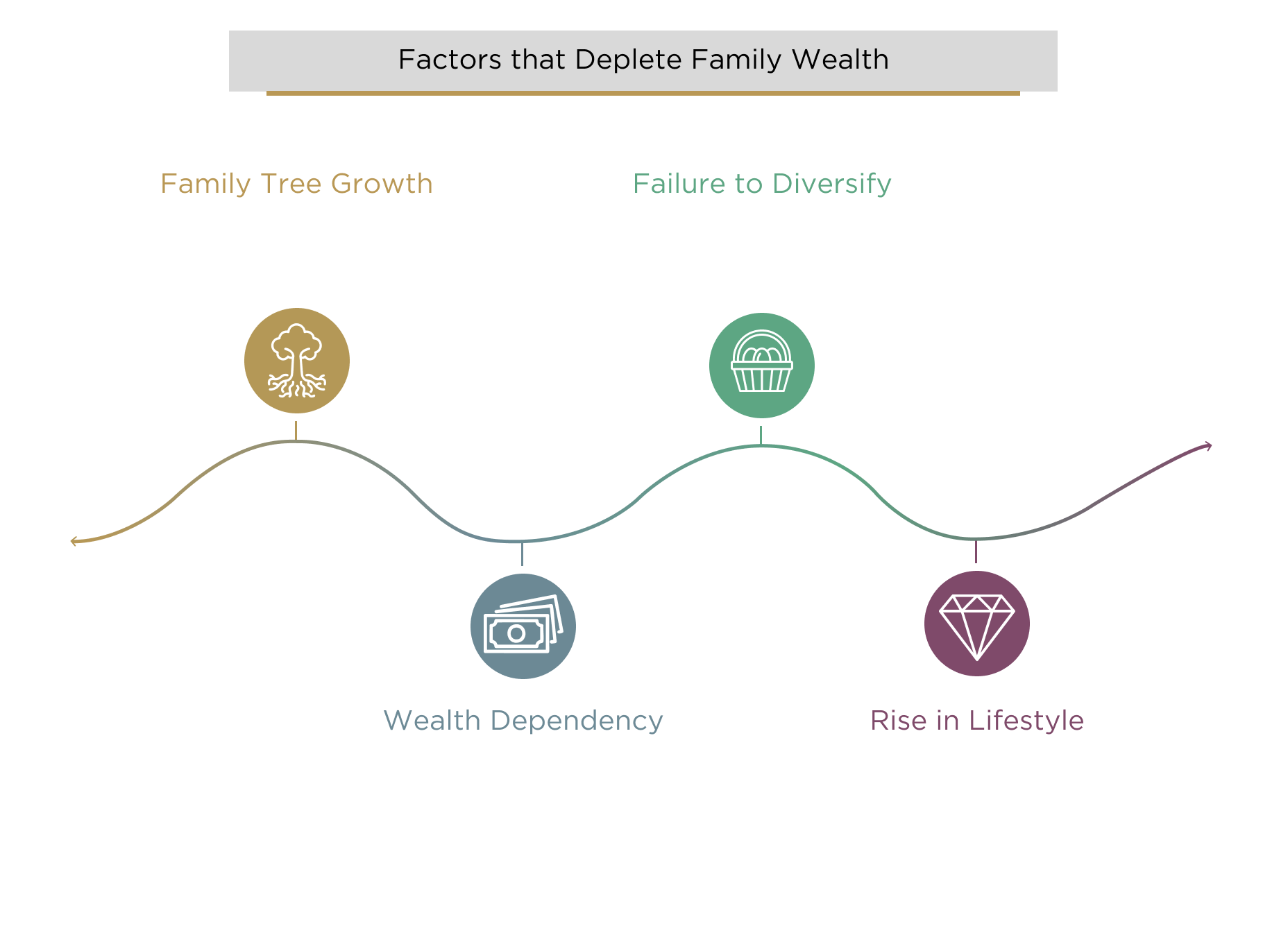

This predicament is so common it has inspired the well-known adage, "from shirtsleeves to shirtsleeves in three generations." Research has shown that a staggering 70% of family fortunes are lost by the second generation, and 90% by the third.[1] The reasons are rarely a single cataclysmic event, but rather a slow erosion caused by a confluence of predictable factors. As families expand, the wealth is divided among a growing number of heirs. Lifestyle expectations tend to rise, and a dependency on wealth can supplant the entrepreneurial drive of the founder.

Perhaps the most significant challenge, however, is a failure to evolve the management of the family’s assets. Wealth that is highly concentrated in a core operating business, the very engine of its creation, becomes a critical vulnerability. Without a structured approach to diversification, families remain exposed to industry cycles, competitive disruption, and a simple lack of liquidity.

The Evolution of Need: From Operating Company to Financial Institution

As family wealth expands, its complexity grows exponentially, demanding a fundamental shift in oversight and strategy. This journey typically follows a distinct evolutionary path:

Operationally Centric: Initially, family wealth is almost entirely synonymous with the family business. Financial decisions are viewed through the lens of the company’s needs, and personal and corporate assets are often intertwined. The primary focus is, rightly, on operational excellence.

A Mix of Operational and Financial: Over time, as profits are realized, families begin to build a portfolio of assets outside the core business. This is a critical inflection point where complexity multiplies. The family must now simultaneously oversee an active operating company while making sophisticated financial investment decisions, two vastly different disciplines.

Financially Centric: Ultimately, a family may transition completely out of daily operations, whether through a strategic sale or generational handover. At this stage, they are no longer business operators but custodians of a diversified portfolio of financial assets. They have, in effect, become a private financial institution, and must begin to act like one.

It is this transition that exposes the inadequacy of informal or ad-hoc wealth management. The discipline, resources, and strategic foresight required to navigate global markets, manage risk, and allocate capital effectively are simply beyond the scope of an individual or an unstructured committee. The family requires a new paradigm: an institutional framework.

Adopting an Institutional Mindset: The Five Guiding Questions

Embracing an institutional approach begins with asking the right strategic questions. This marks a shift from reactive problem-solving to the proactive, disciplined framework required for long-term preservation. While some foundational questions can be addressed internally, the path to true institutional rigor quickly moves into territory that demands deep, specialized expertise.

The family can begin by addressing two foundational questions:

Should I separate my family office from the operating business? This is the first step toward professionalization, creating clear lines between the corporate entity and the family’s private wealth to mitigate conflicts of interest and enable objective financial decision-making.

What functions should I keep in-house versus outsource? This is a critical debate about core competency. A family must decide which functions are central to its control and which are better handled by external experts who offer greater efficiency, technology, and specialization.

While answering these initial questions sets the stage, the next layer of inquiry reveals the full complexity of modern wealth preservation. These are areas where expert guidance may become essential:

How should I structure ownership across jurisdictions and generations? Navigating the labyrinth of international tax law, succession planning, and estate regulations requires specialized legal and financial knowledge to ensure a smooth and efficient transfer of assets.

What investment philosophy should guide my capital deployment? Crafting a formal Investment Policy Statement (IPS) is the cornerstone of disciplined investing. It requires a sophisticated understanding of strategic asset allocation, risk management, and global market dynamics, the core function of a Chief Investment Officer.

What infrastructure do I need to monitor, evaluate, and course-correct? Effective oversight is impossible without institutional-grade reporting, data analytics, and risk management systems. This infrastructure provides the objective, transparent data needed to make informed decisions and maintain accountability.

The journey from wealth creation to multigenerational preservation is a paradigm shift. It requires moving beyond an entrepreneurial footing to adopt the disciplined mindset of an institutional steward. Asking these guiding questions is the first, most crucial step in building a framework robust enough to preserve a family's legacy for the generations to come.