Highlights:

The Federal Reserve (the “Fed”) raises rates by 0.75% for second consecutive meeting

The European Central Bank (ECB) raises rates for first time in 11 years

Record inflation persists

Gazprom supply cuts amplifies worries of a European energy crisis

Equities recover through the month

Policy & Geopolitics

The Fed continues its aggressive rate hike cycle

The Fed raised rates by 0.75% at its November meeting. While Fed Chair Jerome Powell confirmed his commitment to reduce inflation to the 2% target, he also indicated that the Fed is prepared to raise rates in smaller increments as they assess the economic effect of the most aggressive tightening campaign in decades. The Fed is expected to raise interest rates by 0.5% in December rather than 0.75%. The Fed funds rate has risen from near zero in March to a range between 3.75% and 4.0%, and are expected to reach range between 5% and 5.25% by May 2023.

The 7.7% year on year (YoY) rise in the U.S. Consumer Price Index (CPI) in October was the lowest since January and below market expectations. Prices declined for medical care, used vehicles and apparel. The CPI increase of 0.4% in October was below expectations of 0.6%, with shelter contributing for over half the increase.

The Fed had fallen short of its targeted $95 billion million monthly balance sheet reduction since quantitative tightening began, but surpassed its goal by 50% in November with a $139 billion reduction. The Fed has not yet met its target for mortgage-backed securities.

Sources: CNBC, CNN, Bloomberg, Goldman Sachs Research

Markets await how and when the ECB will sell bonds

Having already made a few rate hikes as inflation hit new records, the markets await how and when the ECB will start selling bonds. In October, ECB President Christine Lagarde indicated that bond sales will be determined by the inflation outlook, actions taken to date and transmission lag. In the December meeting, market expected the ECB to reveal how it plans to unwind €8.8 trillion ($9.22 trillion) from its balance sheet.

The ECB has been taking a meeting-by-meeting approach to interest rates, arguing that the high uncertainty prevents it from guiding markets over the medium term. Christine Lagarde said that the changes to the balance sheet will likely be applied only to the Asset Purchase Program (APP) holdings and not to the Pandemic Emergency Purchase Program (PEPP) holdings. The APP began in mid-2014 to address persistently low inflation. It was frozen between January and October 2019, and then lasted until July 2022. The PPP was a more flexible bond purchase program introduced during the pandemic.

The European Union (EU) seeks specialized court to investigate Russia war crimes

The EU has proposed a UN-backed tribunal to investigate possible war crimes by Russia in Ukraine and using frozen Russian assets to rebuild the war-torn country. Since Russian President Vladimir Putin ordered the invasion of Ukraine, his military has been accused of abuses ranging from killings in the Kyiv suburb of Bucha to deadly attacks on civilian facilities, including the March 16 bombing of a theater in Mariupol, which reportedly killed nearly 600 people. Investigations of military crimes in Ukraine are underway around Europe, and the Hague-based International Criminal Court has already launched an investigation.

Macro Indicators

Unemployment Remains Stable

U.S. unemployment was unchanged at 3.7% in November, in line with expectations. The US added 263,000 jobs in November, above the forecast 200,000 but well below the 537,000 uptick in July. Notable job gains in the leisure and hospitality sector drove the decline in unemployment among Hispanic workers. Leisure and hospitality services led payroll gains adding 88,000 positions, followed by food and drinking services adding 62,000 jobs, and healthcare with 45,000 added jobs. Average hourly earnings rose 0.6% in November, double the market forecast. U.S wages increased 5.1% YoY, also above the 4.6% forecast.

Sources: Federal Reserve Bank of St. Louis, Eurostat

Sources: Federal Reserve Bank of St. Louis, Eurostat

*US as of November 2022; Euro Area as of October 2022

Inflation Continues to Weigh on Spending

As of November, the average American household was spending $433 more monthly on the same goods and services it did a year ago. However, consumers spent $9.12 billion online shopping during Black Friday and a record $11.3 billion during Cyber Monday.

Consumer spending, which comprises around 70% of the U.S. economy, increased 0.8% after an unrevised 0.6% increase in September. Inflation-adjusted consumer spending rose 0.5%, the most since January.

Sources:, CNBC, Markit Economics, Eurostat, FRED, Reuters, Moody’s Analytics

Spending on goods increased 1.4%, driven by motor vehicles, furniture and recreational goods. Spending on services increased 0.5%, driven by restaurants and bars and housing and utilities.

U.S. retail sales increased 1.3% in October, above expectations as households increased purchases for goods, suggesting a recovery in consumer spending early in Q4 that could help support the economy.

October U.S. housing starts tumbled 4.2% to an annualized 1.425 million units while September housing starts were revised upward to 1.488 million from an earlier estimate of 1.439 million.

The US CPI annual inflation increased 0.4% in October and 7.7% YoY, below the expected 0.6% and 7.9% respectively. Core CPI, which excludes food and energy, climbed 0.3% in October and 6.3% YoY, slightly below estimates of 0.5% and 6.5%. Eurozone CPI dropped for the first time in 17 months to 10% in November from 10.7% a month earlier.

The IHS Market Manufacturing Purchasing Managers’ Index (PMI) dropped to 47.7 from 50.4 in November in the US and increased to 47.1 from 46.4 in the eurozone.

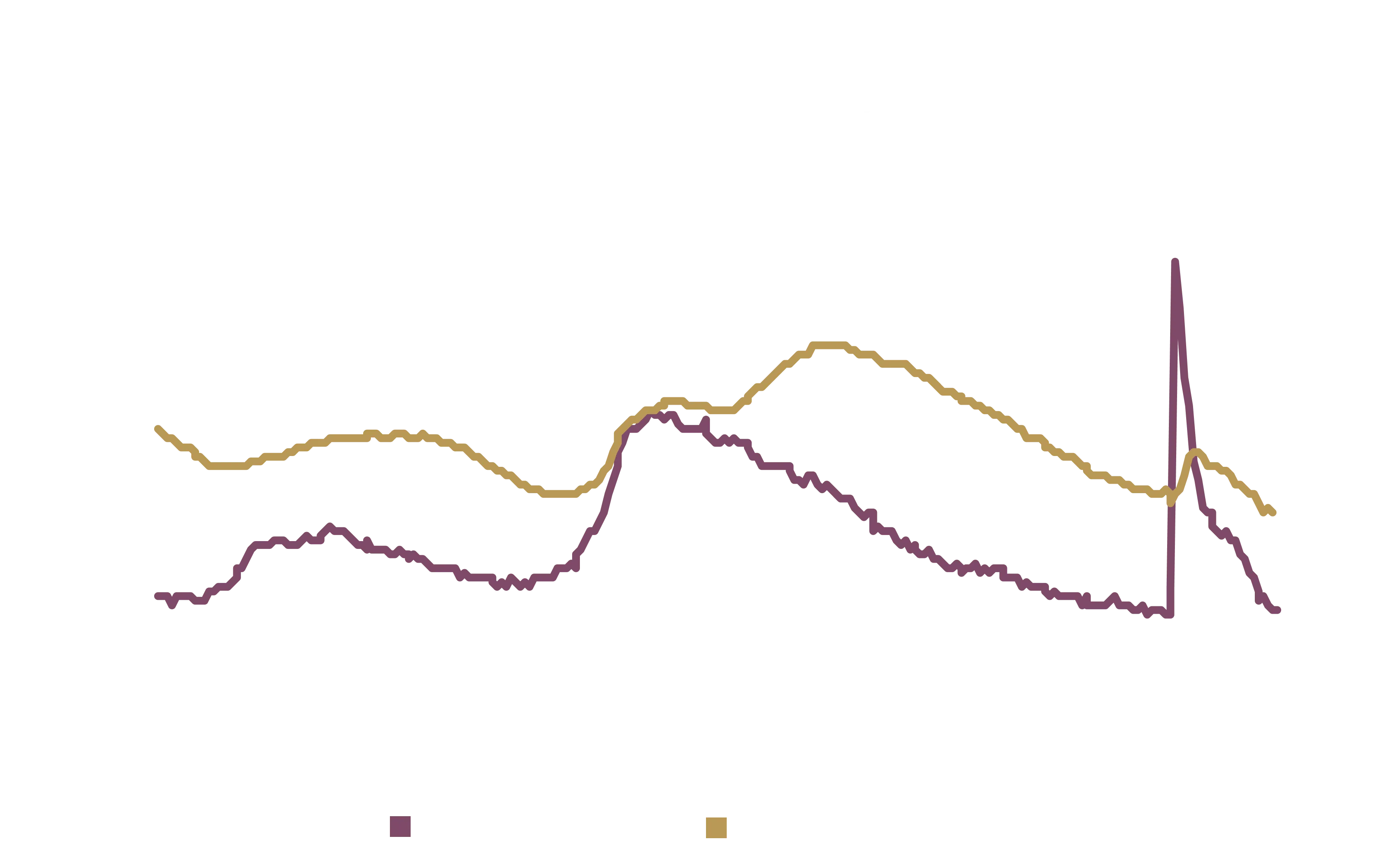

Sovereign bond yields fall as Fed suggest slower rate hikes

U.S. 10-Year Treasury yields fell to 3.61% in November from 4.05% in October as the last Fed minutes suggested slower rate hikes. Germany’s 10-year bund yields also fell in November to 1.93% from 2.14% in October and -0.18% at the beginning of the year.

Source: Bloomberg

Source: Bloomberg

*As of November 30, 2022

Financial Markets

Equity markets continue to rise in November

After recovering in October, US stocks continued to rise in November as the S&P 500, Dow Jones and Nasdaq increased 5.38%, 5.67% and 4.37%, respectively, driven signals of slower rate hikes and easing of Covid restrictions in China.

The STOXX Europe 600 and UK FTSE100 increased 6.75% and 6.74%, respectively, in November. The Chinese SSE Composite Index and Hong Kong Hang Seng index rose 8.91% and 26.62%, respectively, while the Japanese Nikkei 225 Index increased 1.38%.

Credit spreads tighten

Investment grade spreads tightened to 1.42% at the end of November from 1.66% at the end of October, while high-yield spreads also tightened to 4.55% from 4.63%.

Oil prices fall amid worsening conditions

Spot WTI and Brent crude oil prices fell from $86.53 and $92.81 per barrel, respectively, on October 31 to $80.55 and $86.97 on November 30 amid worsening conditions in the U.S. and persisting battle in China to combat coronavirus Sources: Bloomberg, FRED, Reuters, Coinbase

Sources: Bloomberg, FRED, Reuters, Coinbase

OPEC oil production fell in November, led by top exporter Saudi Arabia and other Gulf countries, after the OPEC+ alliance committed to deep production cuts to support the market amid a worsening economic outlook.

In Europe, gas prices climbed at month end after Russia warned it could restrict supplies to western Europe starting December, unsettling energy markets ahead of the winter. The European gas benchmark, TTF, rose 18% to €146 at the end of November. However, wholesale gas prices in Europe fell sharply from the August record high of around €340 per megawatt hour, mainly due to limited industrial demand, higher-than-expected-supply and lower domestic consumption. Russia’s decision will still reinforce concerns about Europe's energy supply in the colder months. Energy inflation in the euro area fell from 41.90% in October to 34.90% in November, easing headline inflation in the region.

Source: Bloomberg

Source: Bloomberg

*As of November 30, 2022

Both the US dollar, gold, and Bitcoin fall

The US dollar started to decrease in November but stayed above 100, closing the month at $105.95 from $111.53 on October 31. Meanwhile, gold prices rose 8.26% in November to $1,769 from $1,634 at the end of October. Bitcoin dropped 16% to $17,173 at the end of the month, over 75% below its all-time high of $68,789.6 on November 10, 2021.

Sentiment

Lower Consumer Sentiment

The Consumer Sentiment Index of the University of Michigan declined 5.2% to 56.8 in November from 59.9 in October and 15.7% YoY.

The VIX index decreased to 20.58 at month end from 25.88 in October.

The month-end Fear and Greed Index (which uses seven factors including market momentum, safe-haven demand, and junk bond demand) showed “Greed” at 70 at the end of November, above the 58 “Greed” at the end of October.

COVID-19

COVID-19

The number of COVID-19 cases and deaths is rising as many countries drop restrictions during the summer.

With easing US restrictions during the summer, cases are rising again, with a seven-day average of 124,312 cases in July compared to 112,693 in June. The Centers for Disease Control and Prevention (CDC) believe infections are likely to be much higher as many at-home Covid tests elude the official data. The Omicron variant dominates new infections, causing around 95% of new cases. Public officials expect a larger wave of infection in the fall as immunity from vaccines fades. The U.S. has agreed a $1.74 billion deal to purchase 66 million doses of the new Moderna vaccine that targets Omicron, and a $3.2 billion deal for 105 million doses of updated Pfizer shots to battle the expected infection wave during fall.

Omicron cases have also surged in Europe through the summer as travel restrictions and mandatory testing requirements eased. Despite an explosion of Omicron cases throughout the continent, governments are not concerned as severe cases that crowd intensive care units have not increased.

China implemented a “zero-covid” policy in May to suppress the virus, using mass testing and lockdowns. The highly transmissible Omicron variant has strained that strategy, especially with the more infectious subvariants, as the seven-day average increased to 686 cases ending July, from 116 at the end of June.

The Month Ahead

1.Fed Meeting on December 13-14

2.Fed Economic Projections on December 14-15

3.ECB Monetary Policy meeting December 15

Disclaimer

This presentation is provided to you by The Family Office Co. BSC(c) (“The Family Office”) for informational purposes only, and contains proprietary information that may not be reproduced, distributed to, or used by, any third parties without The Family Office’s prior written consent.

All information, figures, calculations, graphs and other numerical representations appearing in this presentation have not been audited and may be subject to change over time. Furthermore, certain valuations (including valuations of investments) appearing in this presentation are subject to change as they may be based on either estimates or historical figures that do not reflect the latest valuation. Although all information and opinions expressed in this presentation were obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to their accuracy or completeness. The information contained herein is not a substitute for a thorough due diligence investigation. Past performance is not indicative of and does not guarantee future performance. Exit timelines, prices and related projections are estimates only, and exits could happen sooner or later than expected, or at a higher or lower valuation than expected, and are conditional, among other things, on certain assumptions and future performance relating to the financial and operational health of each business and macroeconomic conditions.

The Family Office makes no representation or warranty, express or implied, with respect to any statistics or historical or current financial data, whether created by The Family Office through its own research or quoted from other sources. With respect to any such statistics or data delivered or made available by or on behalf of The Family Office, it is acknowledged that (a) the investor takes full responsibility for making its own evaluation of the materiality of the information and the integrity of the quoted source and (b) the investor has no claim against The Family Office.

Amounts in currencies other than the US Dollar are translated using prevailing market rates as calculated by The Family Office or its service providers and may differ from the rates used by banks. The rates are indicative only and do not reflect the rates at which The Family Office would be prepared to enter into any transactions with other parties.

Certain information contained in this presentation constitutes “forward-looking statements,” which can be identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “plans,” “estimates,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. To the extent this presentation contains any forecasts, projections, goals, plans and other forward-looking statements, such forward-looking statements are inherently subject to, known and unknown, significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond The Family Office’s control and may cause actual performance, financial results and other projections in the future to differ materially from any projections of future performance, results or achievements expressed or implied by such forward-looking statements. Investors should not place undue reliance on these forward-looking statements. The Family Office undertakes no obligation to update any forward-looking statements to conform to actual results or changes in The Family Office’s expectations, unless required by applicable law.

The Family Office makes no representation or warranty, express or implied, with respect to any financial projection or forecast. With respect to any such projection or forecast delivered or made available by or on behalf of The Family office, it is acknowledged that (a) there are uncertainties inherent in attempting to make such projections and forecasts, (b) the investor is familiar with such uncertainties, (c) the investor takes full responsibility for making its own evaluation of the adequacy and accuracy of all such projections and forecasts so furnished to it and (d) the investor has no claim against The Family Office.

This presentation represents a summary of certain information, the full terms of which are contained in a Private Placement Memorandum that should be reviewed for a more complete understanding of the investments and their risks. In addition, this presentation does not constitute an offer to sell, or a solicitation to buy, any instrument or other financial product, nor does it amount to a commitment by The Family Office to make such an offer at present or an indication of The Family Office’s willingness to make such an offer in the future.

The Family Office is a Category 1 Investment Firm regulated by the Central Bank of Bahrain C.R.No.53871 dated 21/6/2004. Paid Up Capital: US$10,000,000. The Family Office only offers products and services to ‘accredited investors’ as defined by the Central Bank of Bahrain.