Highlights:

The Federal Reserve (the “Fed”) raises rates by 0.75% for second consecutive meeting

The European Central Bank (ECB) raises rates for first time in 11 years

Record inflation persists

Gazprom supply cuts amplifies worries of a European energy crisis

Equities recover through the month

Policy & Geopolitics

The Fed continues its aggressive rate hike cycle

The Fed has increased interest rates by 0.75% for the second consecutive time in their July meeting to a federal-funds rate range between 2.25% and 2.5%, its highest since December 2018. The rate hikes in June and July are the most stringent consecutive action since the Fed began using the overnight funds rate as the main monetary policy tool in the 1990s.

U.S. Consumer Price Index (CPI) reached a 40-year high of 9.1% year-over-year (YoY) in June, increasing 1.3% from May, the most since 2005, exceeding projections for a fourth consecutive month. The record inflation is driven by persistently elevated energy and food prices. Prices for energy, including electricity and natural gas, increased 3.5% from May, the most since 2006. Food costs increased 10.4% YoY, its largest increase in 40 years.

The central bank has also started reducing the asset holdings on its nearly $9 trillion balance sheet, allowing some from maturing bonds to roll off since June. The balance sheet has since declined $16 billion, while the monthly cap of $47.5 billion will increase to $95 billion by September.

ECB proceeds with a larger-than-expected rate hike

The ECB made a surprise 0.5% rate hike, bringing its deposit rate to zero in the first rate hike in 11 years. The central bank had kept rates at historic lows, in negative territory since 2014 as they dealt with the sovereign debt crisis and the pandemic. A smaller rate hike of 0.25% was expected when the ECB declared they would raise rates gradually. ECB President, Christine Lagarde, justified the 0.50% hike amid persisting inflationary pressure, partly due to the falling euro exchange rate against the dollar which increases import prices.

The rate hike amid accumulating challenges and a looming energy crisis following the Ukraine-Russia war may predict an inevitable recession.

The ECB also unveiled a plan to buy the debt of the region’s most vulnerable economies to protect the currency union through surging inflation and slowing economic growth.

U.S. imposes more sanctions on Russia while Gazprom cuts European gas supplies

As the conflict intensifies between Ukraine and Russia, the latter is gaining ground in the Donbas area, with President Zelenskyy ordering a mandatory evacuation of Donetsk, a part of Donbas. The U.S. has applied additional sanctions on Russian oligarchs to weaken the influence of the people and institutions that support the war or are complicit therein. Sanctions include visa restrictions, sanctions on a multinational company and designations for oligarchs and entities involved in finance, technology and scientific research. This affects 893 Russian Federation members and 31 foreign government officials deemed involved in the conflict.

Ending July, Russia announced a 20% reduction in the supplies via Nord Stream 1, citing technical issues at Gazprom. This pushes Europe closer to an unprecedented energy crisis and recession, given its dependence on Russia for 40% of its gas imports. Russia denies the use of gas as a weapon, but Europe no longer considers Gazprom a reliable provider.

Macro Indicators

Job growth accelerates despite record inflation

U.S. unemployment remained at 3.6% in June, adding 372,000 jobs compared to 384,000 in May. The education and health services sector had the largest monthly increase in employment adding 96,000 jobs, followed by professional and business services adding 74,000 jobs. Labor force participation declined 1.2% to 62.2%, 1.2% below its pre-pandemic level.

US wages climbed 5.1% YoY in June. Unemployment in the Euro Area was 6.6% in June 2022, the same as in May 2022 compared to 7.9% in June 2021.

Sources: Federal Reserve Bank of St. Louis, Eurostat

Sources: Federal Reserve Bank of St. Louis, Eurostat

Inflation reaches new highs

U.S. GDP contracted 0.9% in Q2 2022, following a 1.6% fall in Q1 while the Dow Jones estimated a 0.3% gain, amid lower inventories, residential and nonresidential investment, and government spending. Although recession has been traditionally defined as a reduction in GDP for two consecutive quarters, the National Bureau of Economic Research, who declare recessions and expansions, are not expected to make a judgement until months to come.

Consumer spending, which comprises around 70% of the U.S. economy, increased 1.1% in June, compared to a revised 0.3% increase in May. Although consumer spending has remained resilient through major economic disturbances including supply chain and labor issues,

geopolitical tensions and inflation, consumers, especially lower income ones, may be forgoing purchases and saving less to cope with higher prices. Personal income increased 0.6% in June, the same as in May, but dropped 0.3% after adjusting for taxes and inflation.

U.S. retail sales increased 1% in June, above the 0.9% estimate and a big jump from the 0.1% decline in May.

U.S. housing starts fell 2% in June to a seasonally adjusted annual rate of 1.56 million, marking a nine-month low. Eurozone GDP grew 0.7% in Q2 2022, beating expectations of 0.2% and the 0.5% in Q1 2022. The numbers differ vastly from the negative readings in the U.S. as the eurozone continues to benefit from reopening post-pandemic.

The US CPI annual inflation increased 9.1% in June, the highest since November 1981 and above market forecasts of 8.8%. Core CPI, which excludes food and energy, climbed 5.9% YoY in June from a peak of 6.5% in March. CPI and core CPI increased 1.3% and 0.7%, respectively, in June with rises in several categories, which suggests that inflation may not have peaked yet. Eurozone CPI reached a new YoY high at 8.6%, beating predictions of 8.4%.

The IHS Market Manufacturing Purchasing Managers’ Index (PMI) fell to 52.8 in July from 53 in June in the US and dropped to 49.4 from 52 in the Euro area.

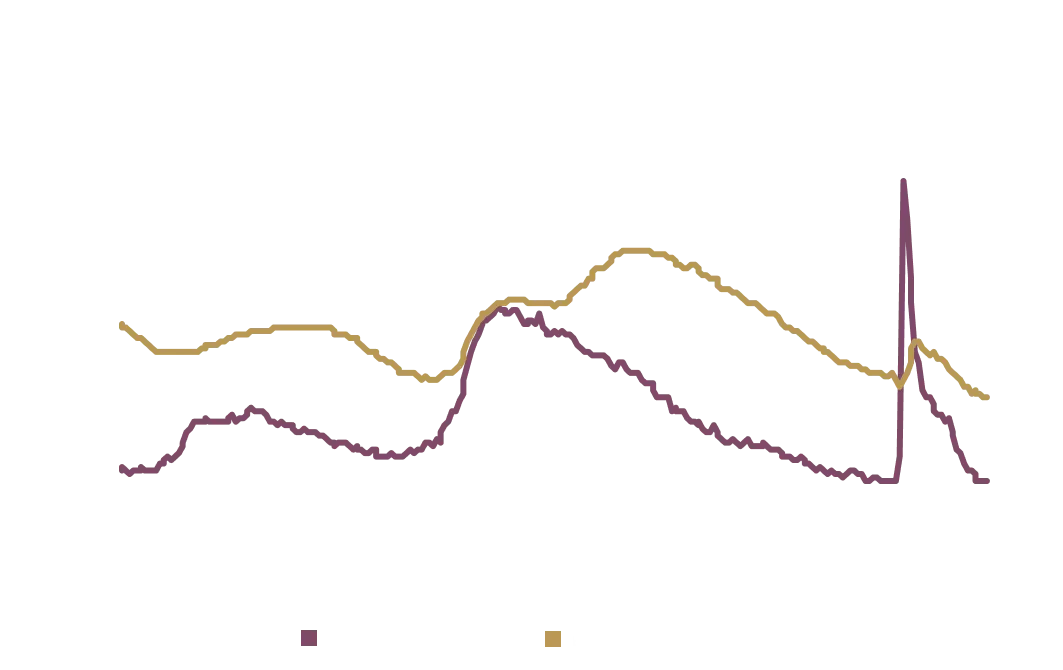

Sovereign bond yields fall amid investor concerns

U.S. 10-Year Treasury yields closed July at 2.65%, from 3.01% in June as investors weighed the prospects of a U.S. recession following two quarters of economic contraction. Germany’s 10-year bund yields also fell, closing July at 0.81% from 1.33% in June.

Source: Bloomberg

Source: Bloomberg

Financial Markets

Equity markets recover

The S&P 500, Dow Jones and Nasdaq rose 9.1%, 6.7% and 12.4% in July, respectively. After a near historic decline over the first half of the year, the indices bounced back in July despite little change in the economy.

The STOXX Europe 600 and UK FTSE100 rose 7.6% and 3.5% respectively, in July. The Chinese SSE Composite Index and Hong Kong Hang Seng index fell 4.3% and 7.8%, respectively, while the Japanese Nikkei 225 Index rose 5.3%.

Credit spreads narrowing

Investment grade spreads narrowed to 1.53% at the end of July from 1.64% in June following the 0,75% hike by the Fed, while high-yield spreads dropped to 4.83% from 5.87%.

Oil prices fall amid recession fears

Spot WTI and Brent crude oil prices fell from $105.76 and $109.03 per barrel, respectively, on 30 June to $95.78 and $95.31 on 14 July amid recession fears but closed July at $98.62 and $103.97 amid worries of lower supply from Russia’s pipeline.

OPEC+ decided to increase their output slightly by 310,000 barrels per day as Gulf supply offset outages in Nigeria and Libya and members delivering nearly 60% of the output increase promised to allies.

OPEC+ decided to increase their output slightly by 310,000 barrels per day as Gulf supply offset outages in Nigeria and Libya and members delivering nearly 60% of the output increase promised to allies.

Energy prices surged in the Euro Area as the conflict in Ukraine intensified. During the last week of July, Russia announced a 20% reduction in supplies via Nord Stream 1 due to technical issues at Gazprom. As the European Union imports 25% of its oil and almost half its gas from Russia, European gas prices soared 14%, before settling 2.5% higher. Energy prices in the Euro Area increased 39.7% YoY in July.

Source: Bloomberg

Source: Bloomberg

US dollar rises, gold and Bitcoin fall

The US dollar stayed above 100, reaching 105.90 on July 29 following the 0.75% rate increase by the Fed. Meanwhile, gold prices fell nearly 2.3% in July to $1,765.90 with the stronger dollar while Bitcoin dropped 27% to $23,307.20, more than 64% below its all-time high of $68,789.6 on November 10, 2021.

Earnings

Mixed Tech earnings overall

Q2 2022 revenues of Apple increased 2% Y0Y to $83.00 billion, above the estimates of $82.81 billion, while its earnings per share (EPS) dropped 8% to $1.20 compared to estimates of $1.16. iPhone revenue increased 3% YoY to $40.67 billion, above the estimated $38.33 billion while service revenue increased 12% to $19.60 billion, above the estimated $19.70 billion. Apple had a record double-digit growth in new switchers to iPhone.

Amazon reported strong Q2 2022 earnings, beating estimates and raising Q3 guidance. Amazon shares rose more than 13% after reporting 7% YoY revenue growth to $121.23 billion (vs. $119.09 billion estimate). Amazon Web Services revenues grew 33% YoY to $19.70 billion vs. a $19.56 billion estimate with an EPS of $0.20. Q3 2022 revenues are expected to grow 13% to 17% YoY to between $125 billion and $130 billion.

Meta shares fell more than 3% after a steeper-than-expected drop in revenue, missed earnings and a weak forecast. Revenue of $28.82 billion was below the estimated $28.94 billion, while EPS of $2.46 was above the expected $2.59. Daily active users of 1.97 billion were slightly above the expected 1.96 billion. But the average revenue per user of $9.82 was slightly below the expected $9.83.

Despite missing Q2 2022 estimated earnings (EPS of $1.21 vs estimate of $1.28) and revenue ($69.69 billion vs. $69.90 billion estimate), Alphabet stock rose more than 4%. YouTube advertising revenues of $7.34 billion were below expectations of $7.52 billion. But Google advertising revenue grew 12% YoY to $56.29 billion.

Microsoft missed estimates but its stock rose 5% after a strong income forecast for the year. Revenues of $51.87 billion were below the expected $52.44 billion, while EPS of $2.23 was below the $2.29 forecast. The 12% YoY revenue growth was the slowest since 2020. Revenue from Azure and other cloud services grew 40%, compared to 46% in Q1 2022.

Tesla revenues grew 42% in Q2 2022, but its automotive profit margins declined to 27.9% from 32.9% Q1 2022 and 28.4% in Q2 2021 due mainly to inflation and more competition for battery cells and other TV components. Revenue of $16.93 billion was above the expected $17.10 billion, while EPS of $2.27 was above the expected $1.81.

Financials deliver strong earnings amid rising interest rates

JP Morgan Chase revenues of $31.63 billion were slightly below the estimated $31.95 billion while the EPS of $2.76 was below the expected $2.88. Profit declined 28% YoY, driven by the reserve for bad loans of $428 million.

Citi group revenue of $19.64 billion was above the expected $18.22 billion, while EPS of $2.19 exceeded the expected $1.68 as the bank benefitted from rising interest rates and strong trading results.

Morgan Stanley revenue of $13.13 billion was below the expected $13.48 billion, and EPS of $1.39 was below the expected $1.53 as investment banking revenue dropped 55%.

Goldman Sachs revenue of $11.86 billion was above the $10.86 billion expected, while EPS of $7.73 exceeded the $6.58 forecast due to fixed income traders generating approximately $700 million more in revenue.

The performance of Visa, Mastercard and American Express was stronger than expected in Q2 2022. Visa net revenues increased 19% YoY to $7.30 billion while EPS grew 33% to $1.98. Mastercard revenues grew 21% YoY to $5.50 billion, while EPS grew 31% to $2.56. American Express revenue increased 31% YoY to $13.40 billion, while EPS dropped 8% to $2.57 with record card member spending driven by a robust rebound in travel and entertainment.

Strong earnings for Energy and Industrials

Exxon Mobil and Chevron posted record profits as commodity prices boomed.

Exxon Mobil earnings grew to $17.90 billion from $4.70 billion a year earlier while EPS rose to $4.14 from $1.10, driven by increased production, higher realizations and tight cost control.

Chevron earnings grew to $11.62 billion from $3.08 billion a year earlier while EPS rose to $5.82 from $1.71.

The revenues of Caterpillar, often considered a barometer for the economic cycle, grew 11% YoY to $14.25 billion (vs. expected $14.35 billion) due to favorable price realization and higher sales. EPS grew to $3.18 from $2.60 a year earlier.

Sentiment

Improved consumer sentiment despite slower expected growth

The Consumer Sentiment Index of the University of Michigan increased 3% to 51.5 in July from 50.0 in June but dropped 36.6% YoY amid concern over inflation and a weakened economy in 2022.

The VIX index dropped to 21.33 in July from 28.71 in June, as equity markets recovered swiftly through the month.

The month-end Fear and Greed Index (which uses seven factors including market momentum, safe-haven demand, and junk bond demand) showed “Fear” at 42 at the end of July, as investors flee risky stocks for the safety of bonds.

COVID-19

COVID-19

The number of COVID-19 cases and deaths is rising as many countries drop restrictions during the summer.

With easing US restrictions during the summer, cases are rising again, with a seven-day average of 124,312 cases in July compared to 112,693 in June. The Centers for Disease Control and Prevention (CDC) believe infections are likely to be much higher as many at-home Covid tests elude the official data. The Omicron variant dominates new infections, causing around 95% of new cases. Public officials expect a larger wave of infection in the fall as immunity from vaccines fades. The U.S. has agreed a $1.74 billion deal to purchase 66 million doses of the new Moderna vaccine that targets Omicron, and a $3.2 billion deal for 105 million doses of updated Pfizer shots to battle the expected infection wave during fall.

Omicron cases have also surged in Europe through the summer as travel restrictions and mandatory testing requirements eased. Despite an explosion of Omicron cases throughout the continent, governments are not concerned as severe cases that crowd intensive care units have not increased.

China implemented a “zero-covid” policy in May to suppress the virus, using mass testing and lockdowns. The highly transmissible Omicron variant has strained that strategy, especially with the more infectious subvariants, as the seven-day average increased to 686 cases ending July, from 116 at the end of June.

The Month Ahead

Fed meeting

ECB Monetary Policy meeting

Conflict in Ukraine

Disclaimer

This presentation is provided to you by The Family Office Co. BSC(c) (“The Family Office”) for informational purposes only, and contains proprietary information that may not be reproduced, distributed to, or used by, any third parties without The Family Office’s prior written consent.

All information, figures, calculations, graphs and other numerical representations appearing in this presentation have not been audited and may be subject to change over time. Furthermore, certain valuations (including valuations of investments) appearing in this presentation are subject to change as they may be based on either estimates or historical figures that do not reflect the latest valuation. Although all information and opinions expressed in this presentation were obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to their accuracy or completeness. The information contained herein is not a substitute for a thorough due diligence investigation. Past performance is not indicative of and does not guarantee future performance. Exit timelines, prices and related projections are estimates only, and exits could happen sooner or later than expected, or at a higher or lower valuation than expected, and are conditional, among other things, on certain assumptions and future performance relating to the financial and operational health of each business and macroeconomic conditions.

The Family Office makes no representation or warranty, express or implied, with respect to any statistics or historical or current financial data, whether created by The Family Office through its own research or quoted from other sources. With respect to any such statistics or data delivered or made available by or on behalf of The Family Office, it is acknowledged that (a) the investor takes full responsibility for making its own evaluation of the materiality of the information and the integrity of the quoted source and (b) the investor has no claim against The Family Office.

Amounts in currencies other than the US Dollar are translated using prevailing market rates as calculated by The Family Office or its service providers and may differ from the rates used by banks. The rates are indicative only and do not reflect the rates at which The Family Office would be prepared to enter into any transactions with other parties.

Certain information contained in this presentation constitutes “forward-looking statements,” which can be identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “plans,” “estimates,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. To the extent this presentation contains any forecasts, projections, goals, plans and other forward-looking statements, such forward-looking statements are inherently subject to, known and unknown, significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond The Family Office’s control and may cause actual performance, financial results and other projections in the future to differ materially from any projections of future performance, results or achievements expressed or implied by such forward-looking statements. Investors should not place undue reliance on these forward-looking statements. The Family Office undertakes no obligation to update any forward-looking statements to conform to actual results or changes in The Family Office’s expectations, unless required by applicable law.

The Family Office makes no representation or warranty, express or implied, with respect to any financial projection or forecast. With respect to any such projection or forecast delivered or made available by or on behalf of The Family office, it is acknowledged that (a) there are uncertainties inherent in attempting to make such projections and forecasts, (b) the investor is familiar with such uncertainties, (c) the investor takes full responsibility for making its own evaluation of the adequacy and accuracy of all such projections and forecasts so furnished to it and (d) the investor has no claim against The Family Office.

This presentation represents a summary of certain information, the full terms of which are contained in a Private Placement Memorandum that should be reviewed for a more complete understanding of the investments and their risks. In addition, this presentation does not constitute an offer to sell, or a solicitation to buy, any instrument or other financial product, nor does it amount to a commitment by The Family Office to make such an offer at present or an indication of The Family Office’s willingness to make such an offer in the future.

The Family Office is a Category 1 Investment Firm regulated by the Central Bank of Bahrain C.R.No.53871 dated 21/6/2004. Paid Up Capital: US$ 10,000,000. The Family Office only offers products and services to ‘accredited investors’ as defined by the Central Bank of Bahrain.