Understanding the Basics: Will vs. Trust

Before choosing between a will or a trust, it is essential to understand what each document does.

Will: A will is a legal document that outlines your wishes regarding the distribution of your assets, the care of minor children, and the appointment of an executor to manage your estate after your death. Wills are typically used for straightforward estate planning and are a common choice for those with relatively simple estates.

Trust: A trust is a fiduciary arrangement in which a trustee holds assets on behalf of one or more beneficiaries. Trusts can be structured in many ways to provide greater flexibility and control over how and when assets are distributed. Certain types of trusts, such as living trusts, can also take effect during your lifetime and continue after your death.

The Main Differences Between Wills and Trusts

While both wills and trusts are used to manage and distribute assets, they differ in several key ways:

Probate: Wills generally go through probate, a court-supervised process that is public and can take months or even years to finalize. Trusts, however, typically bypass the probate process, allowing for quicker, more private distribution of assets.

Effective Date: A will becomes effective upon your death, while certain trusts, particularly a living trust, can be effective during your lifetime, which means it may manage assets in the event of your incapacity, as well as after your death.

Privacy: Since a will must go through probate, the details of the will are made public. On the other hand, trusts are private documents and do not become part of the public record.

Control: Trusts offer greater control over how and when assets are distributed. For example, wills generally result in a lump-sum distribution after probate.

Complexity and Cost: Wills are simpler and less expensive to create compared to trusts, which can be more complex and involve higher upfront costs.

Taxation: Certain types of trusts may help mitigate estate taxes, helping to preserve the value of assets for beneficiaries.

Shariah Law Perspective: Wills and Trusts in the Middle East

For individuals living in Middle Eastern countries or those who wish to ensure compliance with Islamic principles, it is essential to consider how Shariah law affects estate planning:

Shariah-Compliant Wills (Wasiyyah): Under Shariah law, an individual may only bequeath up to one-third of their estate to non-heirs or for charitable purposes. The remaining two-thirds must be distributed among specified heirs according to the rules of Islamic inheritance law (Faraid). This means that, unlike in Western jurisdictions, an individual’s discretion in distributing their assets is limited. Any will must comply with these limitations to be valid under Shariah law.

Trusts (Waqf): The Islamic equivalent of a trust is a waqf. A waqf allows individuals to allocate assets for religious, charitable, or family purposes. While similar to a trust, a waqf is typically irrevocable and must comply with Shariah rules. Waqf is a tool widely used across the Islamic world for religious endowments, charitable causes, and occasionally to provide for family members within the constraints of Faraid.

Probate and Courts: In many Middle Eastern countries, inheritance matters are handled by Shariah courts or designated authorities, which strictly apply Islamic law. Probate in these regions may differ from Western jurisdictions, and privacy considerations may vary.

When a Will Might Be Sufficient

A will may be sufficient for your estate planning needs if:

Your estate is relatively simple and straightforward

You do not anticipate conflicts or mismanagement of your estate by heirs

You wish to appoint a guardian for minor children

You are comfortable with your estate going through probate and becoming a matter of public record

You are comfortable with your estate going through probate before distribution

You understand and are prepared to observe the formal restrictions imposed by Shariah law, if applicable

Wills are best for those seeking a cost-effective, straightforward solution. However, under Shariah law, any bequest must adhere to fixed shares, and discretion in asset distribution is limited.

When a Trust Might Be Beneficial

A trust may be more beneficial if:

Your estate is large or involves complex assets

You own real estate or assets across multiple states or countries and wish to avoid multiple probate proceedings

You value privacy and wish to keep the details of your estate and beneficiaries private

You want to ensure that assets are managed responsibly, particularly for minor children, individuals with disabilities, or beneficiaries who may not manage finances well

You want to make provisions for incapacity, ensuring that your assets are managed smoothly

You wish to minimize estate taxes or provide for charitable causes with specific conditions

You want to create a waqf in compliance with Shariah law to support charitable or family purposes

Trusts come in various forms, including those recognized under Shariah, such as waqf. Each type serves different purposes and offers unique benefits. For Muslims, ensuring that the trust or waqf is structured in compliance with Shariah is essential.

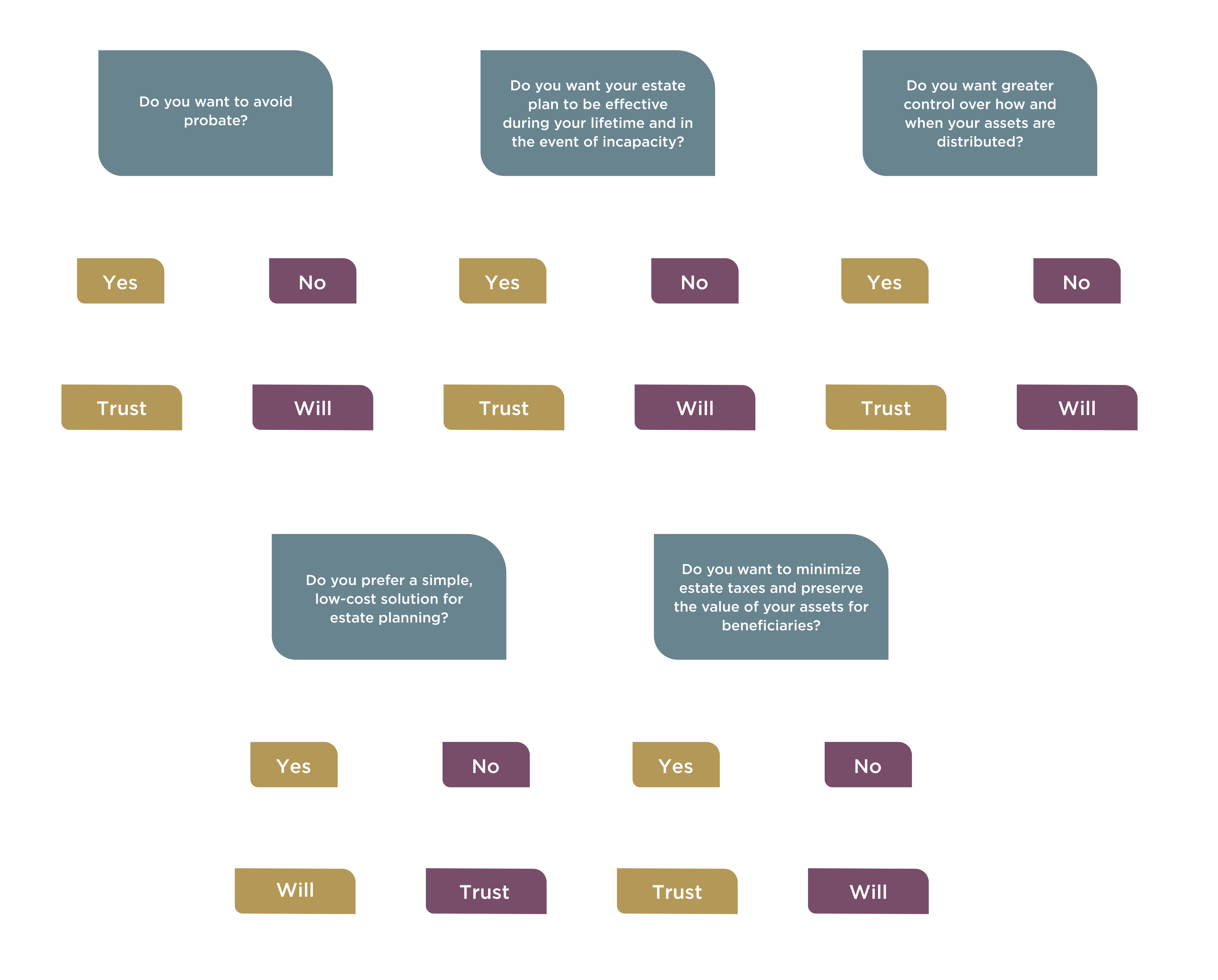

Factors to Consider When Deciding

When deciding between a will or a trust, it is essential to ask yourself the following questions:

Do I have minor or dependent children?

Do I own significant assets or real estate in more than one country?

Am I concerned about privacy and want to avoid public probate proceedings?

Do I want to avoid the time and expense of probate?

Do I need to plan for incapacitation?

Are there beneficiaries who require protection or oversight in managing assets?

Do I need to comply with Shariah inheritance laws or local regulations?

What are the legal and financial implications of each option in my country of residence?

If your circumstances require adherence to Islamic law, consult a professional familiar with both Shariah and local regulations.

The Role of Professional Guidance

Estate planning, particularly when it involves international or religious considerations, can be complex. Consulting with an experienced estate planning attorney, and, when applicable, a Shariah law expert, is highly recommended. These professionals can:

Assess your individual circumstances and goals

Explain the legal and religious implications of your choices

Draft legally valid documents that comply with all relevant laws

Advise you on updating your estate plan as your life situation evolves

Common Myths About Wills and Trusts

Myth: Only wealthy people need a trust or waqf.

Reality: These tools can benefit anyone who is concerned about privacy, control over asset distribution, or religious compliance.Myth: A will avoids probate or Shariah court.

Reality: Wills still typically require probate or review by a Shariah court, especially in the Middle East.Myth: You lose control of your assets if you create a trust or waqf.

Reality: With proper structuring, you can retain control over your assets, and a waqf can provide long-term benefit for charitable or family purposes.

Making the Right Choice for You

Choosing between a will and a trust requires careful consideration of your assets, family structure, religious obligations, and legal environment. Whether you decide to use a will or trust, the right choice will protect your legacy, uphold your wishes, and provide for your loved ones both in this life and for generations to come. If you are in the Middle East or wish to follow Shariah law, it is especially important to consult with an expert who can guide you in ensuring that your estate plan aligns with both your personal and religious goals.

For more personalized support, contact your relationship manager for a wealth planning assessment.