What Is OCIO?

OCIO services involve delegating either full or partial investment management responsibilities to an external firm. This firm, acting as a fiduciary, makes discretionary investment decisions or provides advisory services and oversight at overall portfolio level. OCIO providers offer a broad range of services: from traditional investment advisory to full-service management, where they implement and continuously manage the investment strategy. This model allows clients to benefit from specialized expertise, operational efficiency, and reduced internal workload.

Why Now? The Drivers Behind the Popularity of OCIO

Several key factors have converged to elevate the role of OCIOs in today’s investment landscape:

Increased Complexity in Wealth Management: The proliferation of investment options, growing regulatory frameworks, and heightened risk management concerns have made it challenging for many families and institutions to effectively manage portfolios in-house.

Technological Advancements: Innovations in technology, including real-time reporting, advanced risk analytics, and automated portfolio management tools, are now accessible to OCIO providers. These tools were once exclusive to the largest institutions, but now OCIOs enable smaller organizations to leverage these same cutting-edge resources.

Post-Pandemic Shift: The global pandemic catalyzed a transformation in how organizations structure their operations. With an emphasis on agility and resilience, OCIO solutions allow institutions to tap into external expertise and infrastructure without the burden of maintaining large internal teams.

The Evolution of OCIO Post-COVID: The Role of Technology

The pandemic accelerated the adoption of digital technologies across industries, with investment management being no exception. OCIO providers are now utilizing cloud-based platforms, artificial intelligence, and advanced analytics to offer clients seamless, data-driven services. Remote work and virtual collaboration have become standard, making it easier for organizations to interact with OCIOs no matter where they are located.

Clients are now demanding greater transparency, customization, and real-time access to portfolio data. In response, OCIOs are investing in technology that delivers these capabilities, offering clients tailored solutions and instant insights into portfolio performance and risks.

As McKinsey & Company highlights,[1] the shift toward modernizing technology infrastructure has become essential for asset managers to remain competitive and responsive in an increasingly dynamic environment. This modernization supports enhanced decision-making, more secure investments, and a more robust risk management framework, all of which are key factors driving the growth and sustainability of the OCIO model.

Is OCIO Here to Stay?

The evidence suggests that OCIO is more than a temporary trend. It addresses several fundamental challenges facing investors today, including resource constraints, comparability challenges, regulatory complexity, and the need for specialized expertise. As long as these challenges persist, the demand for OCIO solutions is expected to remain strong.

Moreover, the ongoing investment in technology and the increasing sophistication of OCIO services point to sustained growth. As organizations continue to seek greater efficiency, improved governance, and better investment outcomes, OCIO is poised to remain a core component of the investment management ecosystem.

Industry reports confirm this trajectory. According to a Cerulli Associates report,[2] assets managed by OCIO providers are expected to exceed $5.6 trillion by 2029, with $1.3 trillion in new client assets expected to flow into the OCIO sector over the next five years.

Who Uses OCIO and What’s Driving Its Growth?

OCIO services are widely used by institutions such as endowments, pension plans, family offices, and large corporations, as well as ultra-high-net-worth individuals with extensive investments across multiple asset classes. These clients often lack the resources or expertise to manage complex investment portfolios internally, making OCIO a highly attractive alternative.

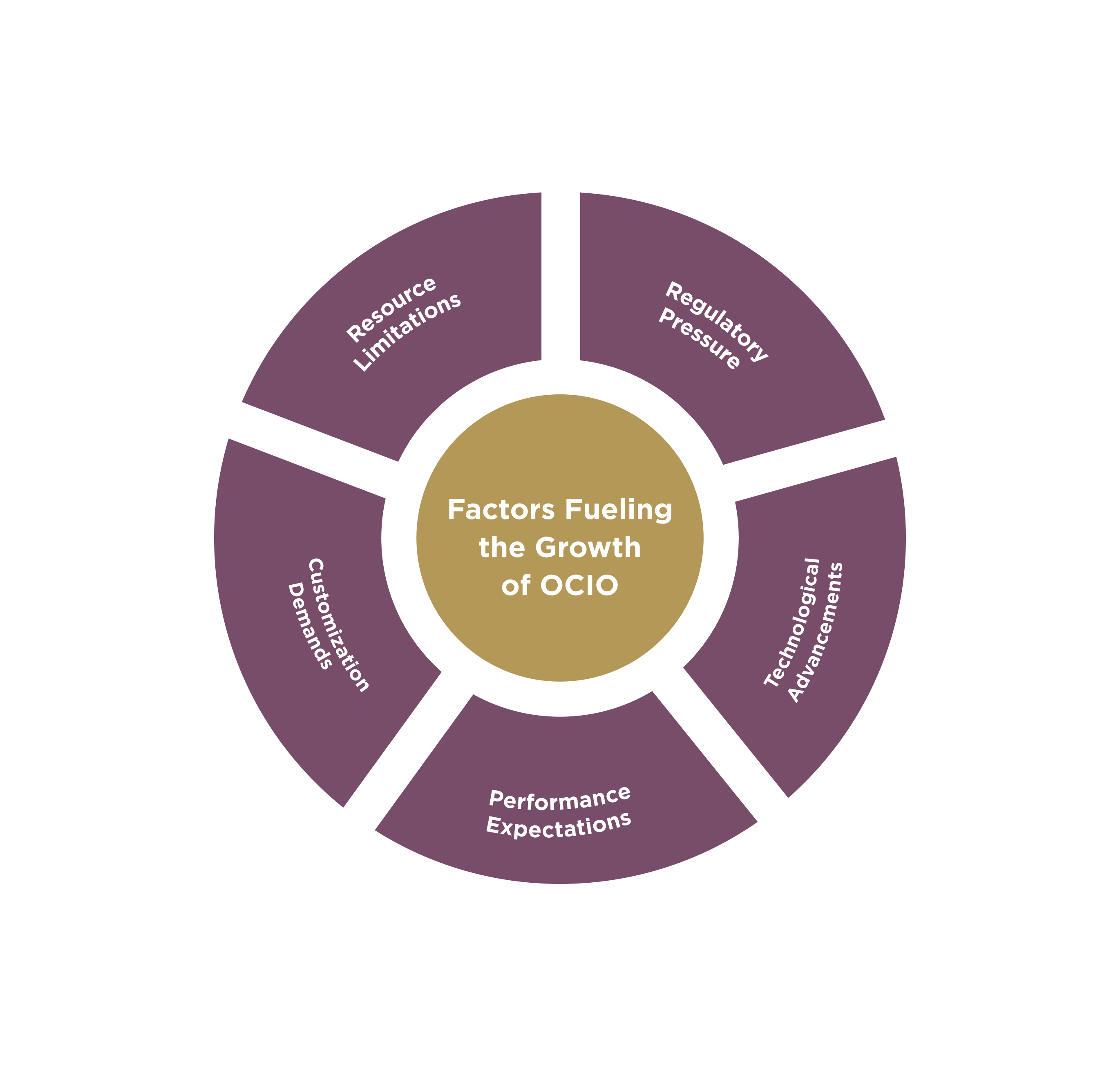

The growth of OCIO is being fueled by several factors:

Resource Limitations: Smaller organizations or individuals can gain access to high-level investment expertise and operational support without the need to build large in-house teams.

Regulatory Pressure: Increasing compliance requirements make it difficult for organizations to manage investments internally, further pushing the demand for OCIO solutions.

Customization Demands: Clients seek tailored solutions that cater to their specific investment needs.

Performance Expectations: Institutions are looking for improved investment outcomes and enhanced risk management.

Technological Advancements: Access to sophisticated tools and platforms levels the playing field for smaller organizations.

Industry reports highlight the robust growth of OCIO mandates globally, with assets under management by OCIO providers reaching record levels in recent years. The model is gaining significant traction not only among traditional users but also new entrants who seek optimized investment strategies.

Conclusion

The OCIO model is reshaping the way institutions approach investment management, driven by both technological innovation and the increasing complexity of wealth management. While its current growth might appear to be a trend, the fundamental challenges it addresses signal that OCIO is, in fact, a permanent fixture in the investment management landscape. As the sector evolves, OCIO solutions will continue to offer organizations the expertise, agility, and performance necessary to navigate a rapidly changing global market.

For more information on how OCIO services can support portfolio growth and governance, please contact your relationship manager.