The Hidden Costs of Siloed Data

Portfolios held across multiple custodians, asset managers, and geographic jurisdictions inherently produce disparate data streams. These streams often lack common reporting standards, valuation frequencies, and performance metrics. Relying on this fragmented information architecture creates material risks that can compound over time.

Obscured Risk Exposures: An unaggregated view makes it exceptionally difficult to quantify true portfolio exposure to specific sectors, currencies, or underlying risk factors. Seemingly diversified manager allocations may conceal concentrated bets on the same handful of securities or industries, exposing the portfolio to amplified downside risk during periods of market stress.

Sub-optimal Capital Allocation: Without clean, comparable data, the rigorous analysis required for effective manager selection and performance attribution becomes unfeasible. Underperforming assets may remain undetected, while opportunities for strategic rebalancing or tax-loss harvesting are missed, leading to a persistent drag on total returns.

Operational Inefficiency: Family offices and advisory teams frequently report spending upwards of 20% of their time on manual data collection and reconciliation.[3] This manual process is not only a significant resource drain but is also a primary source of data entry errors, which can lead to flawed analysis and misinformed decision-making.

Impeded Governance and Reporting: The increasing complexity of global regulatory and tax reporting regimes demands precision and transparency. A fragmented data environment complicates compliance, increasing the risk of errors, penalties, and reputational damage.

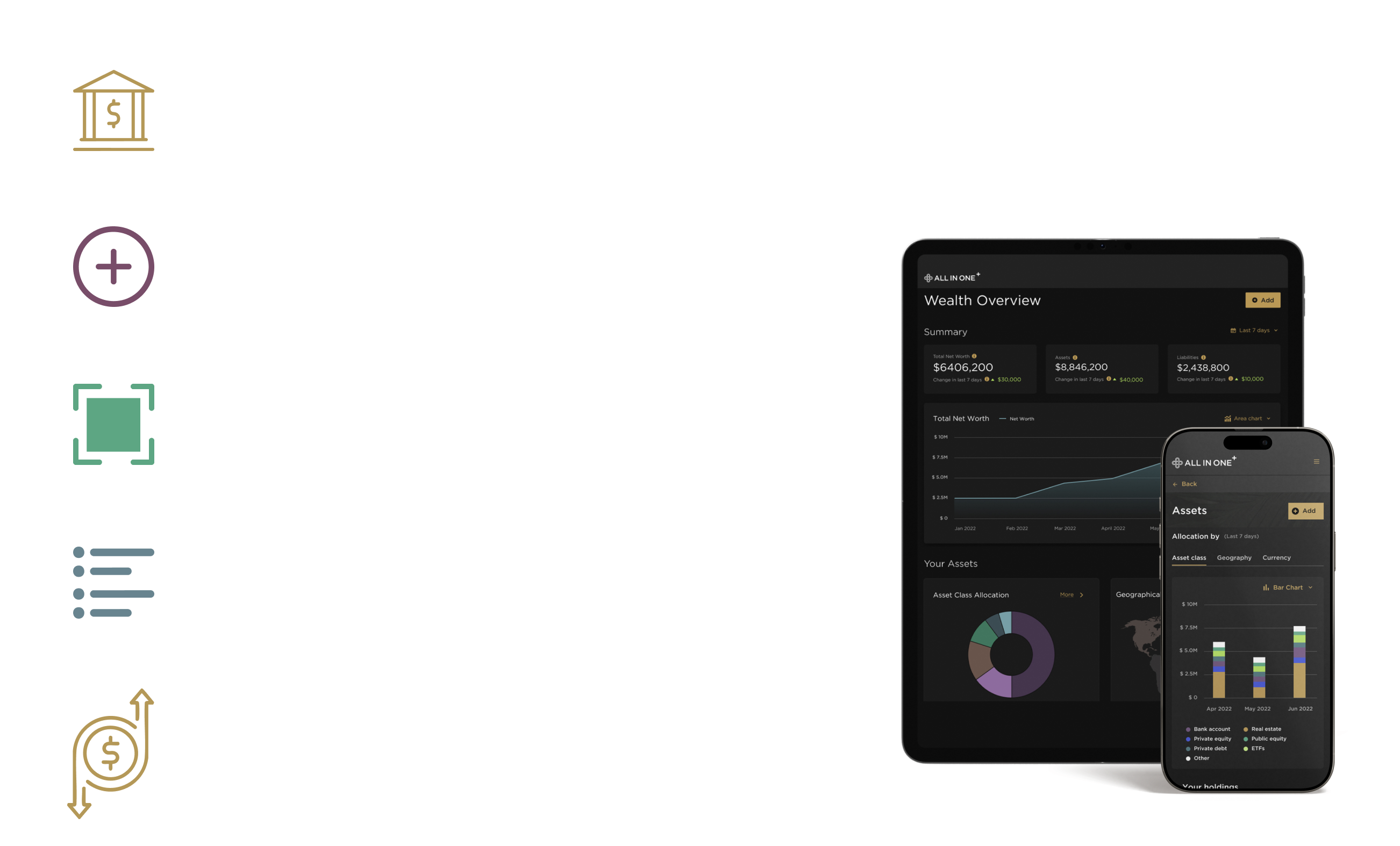

These challenges are not merely theoretical. At The Family Office, a survey of our extensive client base revealed that the single most critical pain point was the lack of a clear, aggregate view of their total portfolio. This feedback was the catalyst for All-In-One-Plus (AIO+), a holistic digital wealth management dashboard. Engineered to solve this exact problem, the platform provides a private and highly secure solution to consolidate all asset accounts into a single 360-degree view. It is precisely this integration that delivers the clarity, confidentiality, and control sophisticated investors require to navigate today's complex financial landscape.

To learn more about how AIO+ provides a comprehensive and actionable view of your wealth, visit https://allinoneplus.com/.

To learn more about how AIO+ provides a comprehensive and actionable view of your wealth, visit https://allinoneplus.com/.

A Framework for Consolidated Intelligence: Aggregation and Standardization

To address these challenges, a two-part framework is required: data aggregation as the foundation, and data standardization as the critical enabler of analytics.

1. Data Aggregation: Establishing a Single Source of Truth

Aggregation is the systematic consolidation of financial information from all sources (including global banks, alternative fund administrators, direct real estate holdings, and digital asset custodians) into a single, secure repository. The objective is to create a complete and timely inventory of all assets and liabilities. This comprehensive view provides:

Holistic Portfolio Visibility: Enables an accurate, top-down assessment of the entire balance sheet, clarifying total exposures and asset concentrations.

Centralized Performance Measurement: Facilitates accurate calculation of time-weighted and money-weighted returns across the entire portfolio, serving as the basis for meaningful benchmarking.

Streamlined Operations: Automates the collection of data, eliminating manual reconciliation tasks and reallocating valuable professional resources toward high-value strategic analysis.

2. Data Standardization: Creating Comparability and Analytical Power

Aggregation provides the raw material; standardization refines it into actionable intelligence. This process involves converting disparate data points into a consistent, pre-defined classification system. Key elements include:

Uniform Asset Classification: Applying a consistent schema to all holdings ensures that assets are categorized uniformly across managers and accounts, allowing for true "like-for-like" comparisons.

Consistent Valuation Metrics: Normalizing valuation methodologies and reporting currencies eliminates discrepancies that can distort performance and risk calculations.

Normalized Performance Data: Standardizing metrics such as internal rate of return (IRR), multiple on invested capital (MOIC), and standard deviation allows for objective evaluation of both liquid and illiquid investments.

From Data to Decision: Tangible Outcomes

The integration of aggregated and standardized data provides the analytical infrastructure necessary for superior decision-making, transforming strategic capabilities across core functions.

Dynamic Risk and Exposure Management: A unified data set enables sophisticated risk modeling, including stress testing and scenario analysis. It makes transparent correlated risks, such as overlapping factor exposures or unintended geographic concentrations, allowing for proactive hedging and portfolio rebalancing.

Precision in Strategic Asset Allocation: Clean, standardized data is a prerequisite for robust asset allocation modeling. It allows principals and their advisors to model the impact of tactical shifts with a high degree of confidence and to ensure the portfolio remains aligned with its long-term investment policy statement (IPS).

Enhanced Manager Selection and Oversight: Standardized performance and risk metrics enable objective, data-driven evaluations of investment managers. This facilitates a disciplined process for identifying sources of alpha, validating management fees, and making informed decisions about manager retention or replacement.

Strengthened Governance and Succession: A transparent, accessible, and standardized reporting framework provides a clear and objective basis for communication among family members, trustees, and advisors. This fosters alignment, educates the next generation, and creates a durable governance model for intergenerational wealth transfer.

For UHNW individuals and the family offices that serve them, managing portfolio complexity is a primary challenge. The discipline of investment data aggregation and standardization is no longer a matter of mere operational convenience; it is a strategic imperative. By establishing a single, reliable source of truth, investors can mitigate unseen risks, identify new opportunities, and implement a more rigorous governance framework. This data-driven foundation is essential for preserving and growing significant wealth across market cycles and across generations.

To learn more about implementing a data aggregation and standardization framework for your portfolio, please contact your relationship manager.