This article contends that “hope” alone is not a strategy. To ensure the successful transfer of wealth, active education and structured governance are essential.

The Disconnect Between Ambition and Reality

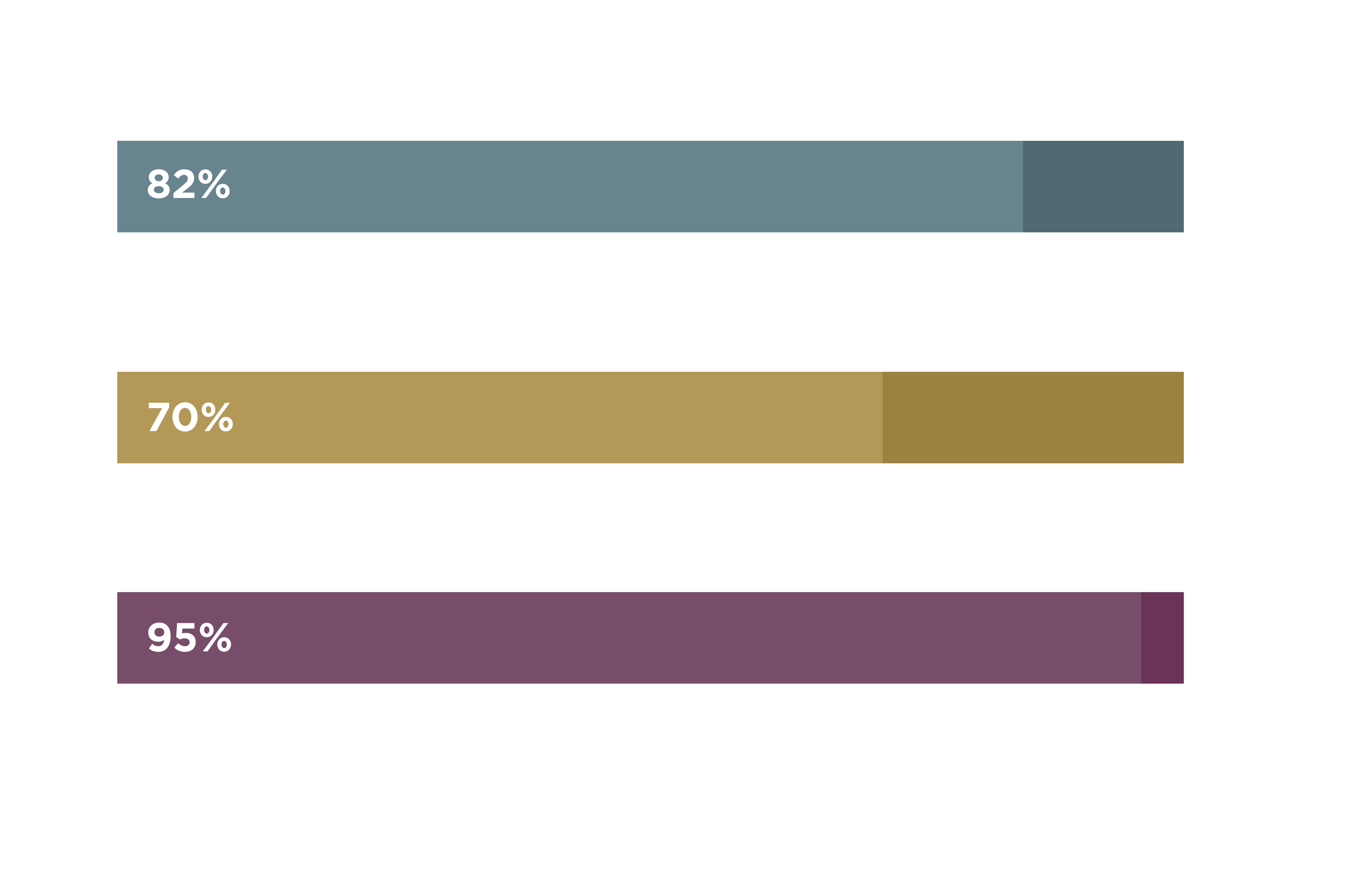

There is a stark disconnect between what parents hope for and what actually happens. In fact, according to the UBS Billionaire Ambitions Report 2025,[1] 82% of billionaires state that fostering independence in their heirs is a top priority. Yet the harsh reality tells a very different story: around 70% of families fail to successfully transfer wealth,[2] either losing assets or family harmony along the way.

The root cause of this failure is striking: 95% of these failures are attributable to the family’s own lack of preparation.[3] Without proactive guidance and education, children who inherit substantial wealth often struggle to manage it responsibly. This paradox underscores a critical truth: hope alone is not a strategy.

Managing Wealth Is Like Lifting Heavy Weights

Managing Wealth Is Like Lifting Heavy Weights

As highlighted in our Intergenerational Wealth Management whitepaper, managing a large estate is like lifting heavy weights. Without the proper preparation, those inheriting substantial fortunes may collapse under the pressure. Often, fortunes are lost not just due to poor financial management, but also because of extravagance and a lack of understanding of investments. It's crucial to establish the “gym” for future heirs long before the wealth transfer occurs, ensuring they are well-equipped to preserve and grow their inheritance.

Education as the Solution

Heirs typically receive inheritance at age 44 from their parents or age 26 from their grandparents.[4] The “training” must happen early, long before the actual transfer. A structured program should include:

Basic financial concepts: compounding, debt management, budgeting.

Advanced topics: trusts, estate planning, tax strategies, and complex investment structures.

By equipping heirs with knowledge, they are far better prepared to preserve and grow the family wealth, rather than inadvertently eroding it.

The Family Office: Turning Heirs into Stewards

The Family Office plays a pivotal role in more than just managing wealth. We offer guidance and support, helping families through a structured framework that provides access to the right resources for developing future heirs. By connecting families with trusted specialists, we foster active participation in governance, promoting continuity, harmony, and long-term wealth preservation across generations.

The Takeaway

If independence is the goal, preparation is the strategy. Without it, even the best intentions can result in lost wealth and fractured families. Successive generations thrive not by chance, but by design.