Success is measured not by short-term reactions but by resilience and consistency, ensuring wealth endures across generations. In this article, we explore how building a structured long-term investment strategy, rooted in discipline, diversification, and access to opportunities, can withstand volatility and help preserve and grow wealth across generations.

To lay the foundation for a resilient long-term investment strategy, it's essential to focus on key principles that guide decisions, shape goals, and provide stability through market cycles. Here are the core elements to consider:

1. Start with Clarity of Purpose

Effective investment strategies begin with well-defined financial objectives. Whether the goal is preserving wealth, maintaining liquidity, or preparing for future generations, clarity of purpose shapes the investment horizon and informs every decision.

At The Family Office, goal-based planning forms the foundation of portfolio construction, ensuring that every investment aligns with both personal and family objectives.

2. The Importance of Diversification

Diversification is essential to managing concentration risk and reducing vulnerability to market fluctuations. By spreading investments across asset classes and geographies, investors can mitigate potential downturns in any single market.

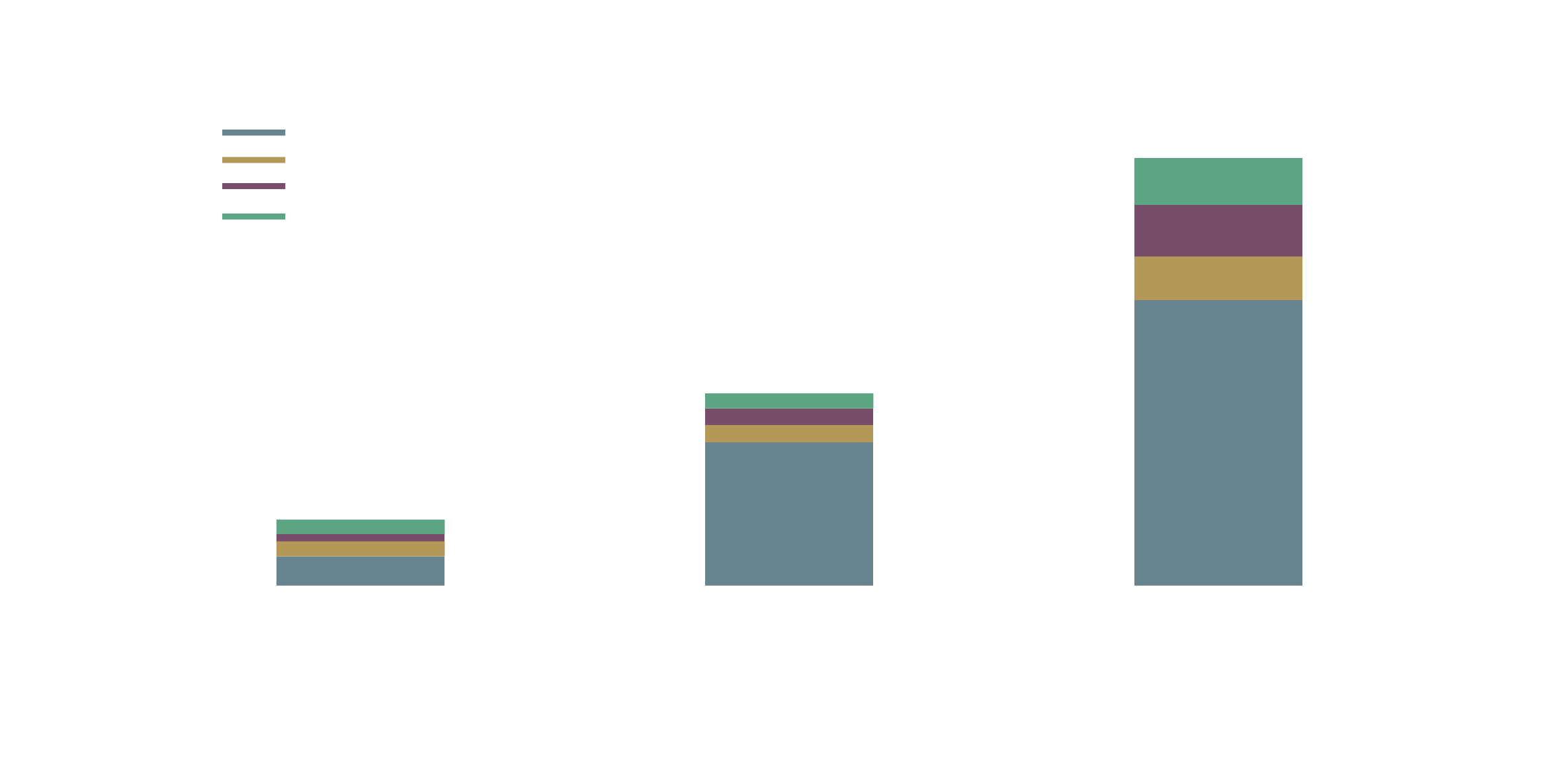

Including private markets in a portfolio, such as private equity, private credit, and real estate, adds another layer of diversification, as they enhance resilience and returns, often behaving differently from public markets and offering opportunities that complement traditional investments. The resilience of private markets was evident in 2022, for instance, when despite a slowing global economy, high inflation, and increased uncertainty, they fell by just 3.5%, while global equities saw a double-digit decline, with sell-offs affecting both developed and emerging markets. [1]

Private markets are also evolving rapidly, with private capital poised for growth and forecasts suggesting continued expansion into the next decade.

The Family Office provides access to carefully curated opportunities in private markets, often unavailable to individual investors, enhancing portfolio resilience and potential for long-term growth.

3. Discipline Through Market Cycles

Emotional decision-making can erode long-term performance, and reactionary shifts during market volatility often undermine well-constructed strategies. Maintaining discipline through cycles is critical, and The Family Office plays a pivotal role in providing guidance and conviction, helping clients remain steadfast during periods of uncertainty. This disciplined approach ensures that long-term objectives remain the central focus, regardless of short-term market disruptions.

4. Family Alignment and Stewardship

Wealth strategies achieve greater success when the family shares a unified vision. Engaging family members fosters accountability and prepares the next generation for responsible stewardship of wealth.

The Family Office supports this process by establishing structures that reflect the family’s long-term goals, promoting alignment across generations, and fostering the preservation and thoughtful management of wealth over time.

5. The Value of a Trusted Partner

Even the most seasoned investors benefit from professional insights, global access, and structured frameworks.

Acting as a long-term partner, The Family Office delivers personalized strategies, access to private market opportunities, and continuity that spans generations. This partnership reinforces disciplined decision-making and provides the expertise necessary to navigate complex financial landscapes.

Conclusion

Long-term investment success is grounded in resilience, foresight, and disciplined execution. By combining clear objectives, diversification, family alignment, and professional partnership, investors can build strategies capable of enduring beyond market cycles. The Family Office guides clients in building such strategies, ensuring wealth not only grows but also stands the test of time.