The data has seldom been more difficult to fathom, and the growing discord between policymakers and the executive branch itself is adding to the confusion. In this article, we will attempt to make sense of it all.

The July Meeting

The most notable feature of the move is the deepening division amongst Fed officials as to the best way forward. For the first time since 1993, two governors (Michelle Bowman and Christopher Waller) dissented from the overall decision, favoring an immediate 25 basis point cut.[2]

The meeting minutes further revealed that there was no widespread consensus as to the relative importance of risk to employment and risk to inflation.[3] This ambivalence was later echoed in Jerome Powell’s Jackson Hole speech (covered in full here), which emphasized the fragility of the current equilibrium.[4]

Some Perplexing Data

The eight-week period since the last meeting of the Federal Open Market Committee (“FOMC”) has seen the release of two market-moving announcements on employment and inflation, addressing the question of whether the dreaded specter of stagflation is stealing into view.

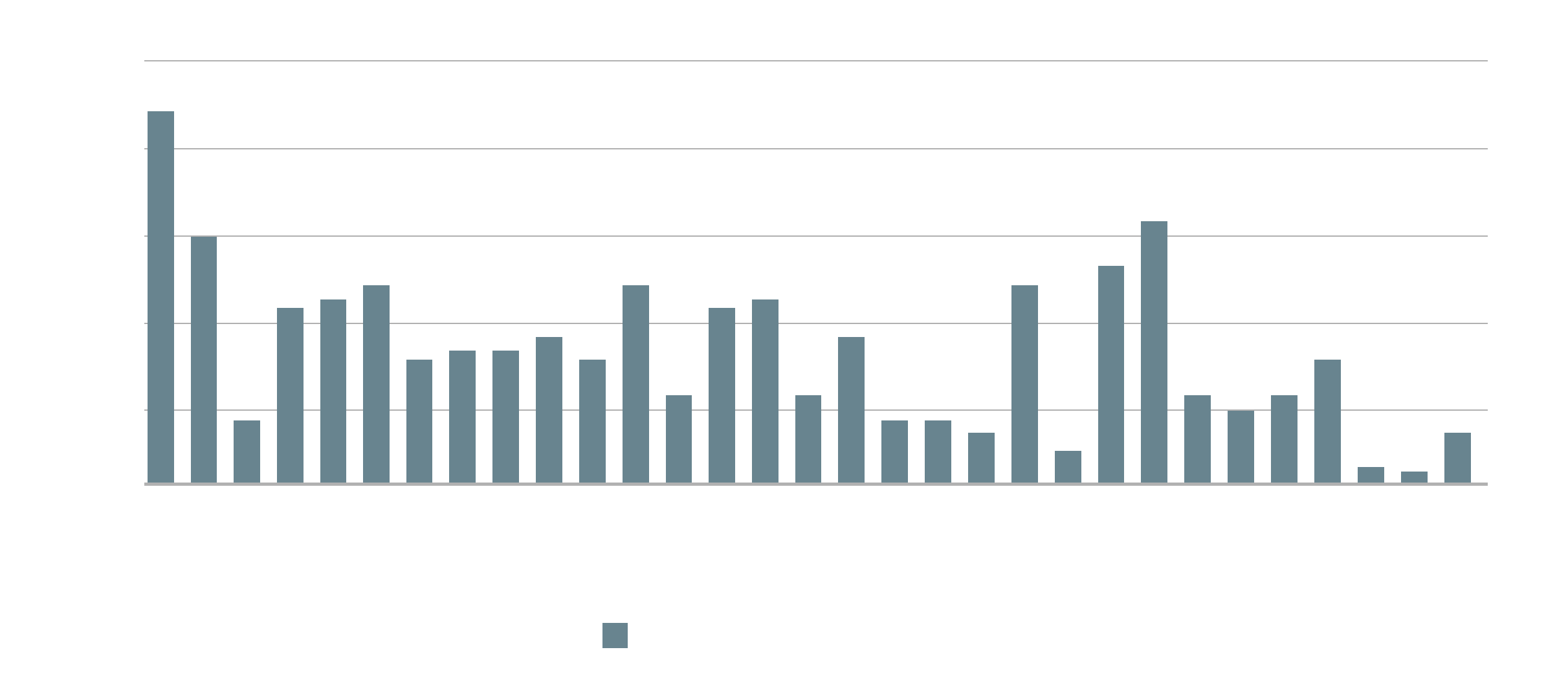

New jobs for July were low at 73,000, and the May and June figures also saw sharp downward revisions to 19,000 and 14,000, respectively.[5] This compares with a monthly average of around 167,000 new jobs per month in 2024, and 216,000 in 2023.[6] The labor market appears to be softening.

This was followed by the Consumer Price Index (CPI) inflation data for July. Headline annual CPI stayed at 2.7%, while Core CPI increased from 2.9% to 3.1%.[7] Both figures are still clearly above the targeted 2.0%.

This was closely mirrored by the more recently released Personal Consumption Expenditures ("PCE") inflation data. Headline PCE stayed level at 2.6%, while Core PCE (excluding Food and Energy) edged up slightly to 2.9%, its highest level since February but in line with expectations.[8]

Meanwhile, Q2 GDP growth was strong at 3.3%,[9] rebounding from the negative growth in Q1 and buoyed by unabated consumer spending. Estimates for full-year GDP do indicate a weaker performance compared to 2024,[10] potentially bolstering the case for rate cuts to stimulate growth. However, the ongoing uncertainty around the impact of tariffs - and its persistence - means that all forecasts should be viewed with caution.

A Growing Discord

Aside from the mixed data, the cacophony of dissenting views is growing in intensity. With Chairman Powell stoically attempting to remain as uncommitted as possible, while slightly inclining towards the dovish camp, his lieutenants are being more vocal.

At the Jackson Hole symposium, Kansas City Fed President Jeffrey Schmid[11] and Cleveland Fed President Beth Hammack[12] both briefed the press corps to the effect that the data to support cuts is not there yet.

On the other side of the debate, Trump appointee Christopher Waller delivered a speech on August 28th with the unambiguous title “Let’s Get On With It”, stressing the need to take action before the labor market suffers further harm.[13]

Conclusion

Amid this disorder and lack of clarity, there are two options. One is to join in with the feverish speculation, attempting to second-guess the next data announcement or political development. The other is to make a conscious effort - and conscious effort is required - to tune out the debilitating barrage of ephemera and look to the longer-term.

According to the latest Fed meeting minutes, several participants expressed the view that the current level of interest is not far above the neutral rate.[14] Neutral rate is the inflation-adjusted short-term rate consistent with the economy operating at potential and inflation stable, i.e., neither stimulating nor restraining growth. This reinforces the expectation that rates will not revert to the lows of the past decade. Moving to a higher-for-longer interest rate era is a significant move, as it changes the physics of both investing and the economy itself. As it is not a one-off event, but a process that can be observed gradually, there is no reason to panic or make rash decisions, no matter how turbid market sentiment may grow.

[5] U.S. Bureau of Labor Statistics

[6] Federal Reserve Bank of St. Louis

[7] U.S. Bureau of Labor Statistics