Private markets, by contrast, offer a different proposition. The potential outcomes are far more dispersed: while the top funds often generate net IRRs above 20%, the lowest performers may struggle to return capital.[1] That wide range is not a drawback; it creates the opportunity for higher returns, provided investors have access to skilled managers.

This distinction is critical. In public markets, success comes from being invested. In private markets, success comes from partnering with skilled managers who know how to source opportunities, add value, and protect capital. When combined thoughtfully, public markets can provide liquidity, while private markets can drive diversification and long-term outperformance.

Together, both markets benefit from strong manager oversight, ensuring investors gain not only performance but also a comprehensive, disciplined view of their overall wealth.

Key Takeaways

Returns in private markets show massive dispersion between top and bottom quartile managers, with the gap averaging 14-18 percentage points annually.

Top funds generate net IRRs above 20% while worst performers may struggle to return capital.

Manager selection is more critical in private markets than in public markets, where index funds replicate the market’s performance.

In private markets, the success of managers stems from deal sourcing access, operational value creation, investment discipline, and risk management.

Capital lock-up periods of 7-10 years mean that choosing the wrong manager can lead to a decade of underperformance.

The J-curve effect is amplified with weak managers who may never recover from early negative returns, leaving investors in prolonged losses.

A partnership with skilled managers transforms private markets into powerful wealth creation drivers, offering long-term results.

Return Dispersion: The Wide Plateau of Opportunity

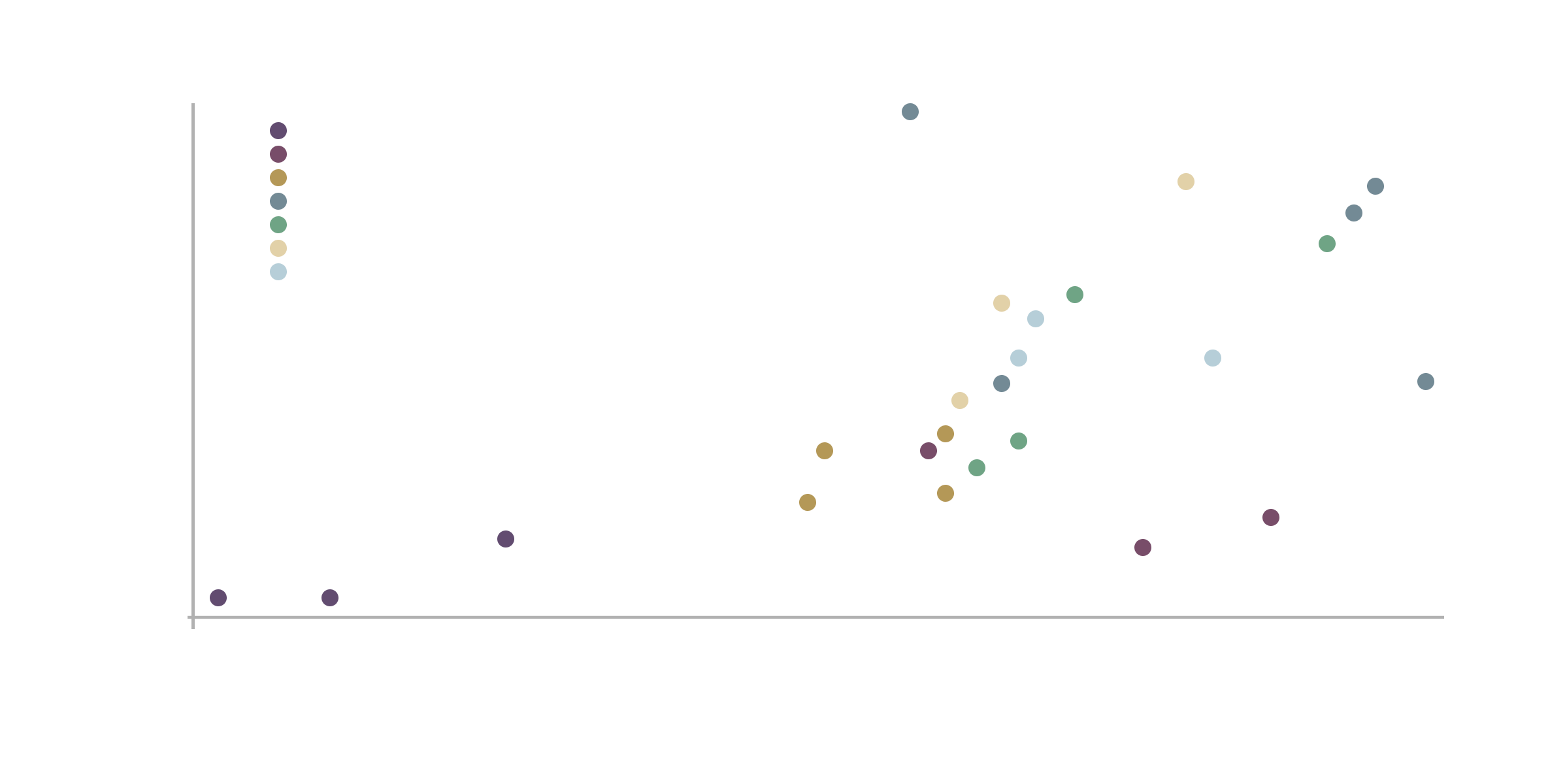

In public markets, most funds deliver returns that cluster tightly around the benchmark, like a narrow mountain peak. In private equity, however, return patterns show much greater variation: investors may experience deep underperformance or dramatic outperformance. This is why private markets are fundamentally about alpha (returns created by manager expertise) rather than beta (the market’s average return).[2]

The numbers illustrate this clearly. Among buyout funds, the gap between the top and bottom quartiles averages around 14 percentage points in annual IRR. In venture and growth equity, the spread is even wider at roughly 18 percentage points. For venture capital specifically, the median IRR is only about 8%, but the best funds can deliver anywhere from 17% to nearly 80%, while the weakest may lose money altogether.[3]

Over a decade, this level of dispersion compounds dramatically. The right partner can turn private markets into a powerful driver of wealth creation, while the wrong one can erode both opportunity and capital.

Over a decade, this level of dispersion compounds dramatically. The right partner can turn private markets into a powerful driver of wealth creation, while the wrong one can erode both opportunity and capital.

What Defines a Top-Performing Manager

In private markets, not all managers deliver the same results. The best are not simply buying assets; they are building long-term value. Similarly, in liquid strategies, the role of the fund manager remains critical in asset selection, risk management, and discipline. What sets them apart is not luck, but discipline and expertise:

Deal Sourcing and Access: They access opportunities others cannot, thanks to proprietary networks, sector knowledge, and relationships that open doors to unique deals.

Operational Value Creation: They actively improve the businesses they invest in. By upgrading management teams, driving efficiency, and expanding into new markets, they create sustainable value rather than relying solely on financial tactics.

Investment Discipline: Top managers remain consistent in their approach. They apply careful valuation standards, invest with patience, and plan exits with precision, regardless of market sentiment.

Risk Awareness: Protecting capital comes first. They avoid overpaying, use leverage conservatively, and diversify across companies and sectors to manage risks over the long term.

This combination of access, discipline, and value creation helps explain why some managers consistently outperform the average.

The principle holds across markets: in private markets, outperformance depends on alpha generation, while in liquid funds, discipline and risk management by the manager provide stability and context.

When the Partner Isn’t Right

Private markets do carry risks, but these are amplified when the wrong partner is chosen, particularly in traditional closed-ended investments. Investors should be aware of three common pitfalls:

Capital Lock-Up: Commitments typically last 7–10 years. Choosing a weak manager means being tied to disappointing outcomes for the entire life of the fund.

The J-Curve: All private equity funds show early negative returns, known as the “J-curve.” Strong managers recover quickly; weak ones may never climb out, leaving investors in prolonged losses.

Opportunity Cost: Capital stuck in underperforming funds cannot be redeployed to better opportunities, resulting in years of lost growth.

Data underscores this reality. A study of over 6,000 private funds (1980–2022) found that the top 95th percentile TVPI (Total Value to Paid-In Capital) was around 4.24× in venture capital and 2.08× in private credit, while the bottom 5th percentile fell as low as 0.36× and 0.81× — in some cases failing to return the original investment.[4]

This range is why investors must view the manager, not just the asset, as the true investment decision. With the right partner, the J-curve is temporary. With the wrong one, it becomes permanent.

The Partnership Imperative

Private markets are ultimately about people. Behind every fund are professionals whose judgment, networks, and discipline determine the outcome. Unlike in public markets, there is no index to guarantee the average return. The “alpha” of private markets is created by the skill of the manager.

For long-term investors, this reinforces a central point: private markets reward selectivity. The critical question is not which company or sector to back, but which partner will be responsible for your capital over the next decade.

Conclusion: The Family Office Approach

Private markets have the potential to deliver results not typically available in public markets, but only if investors have the right partner. Manager selection is therefore not a detail; it is the decision that shapes long-term results. This applies equally to public markets, where selecting the right liquid fund managers can also impact outcomes, though the dispersion is narrower. Together, both public and private strategies form a complementary framework for building resilient portfolios.

Ultimately, working with skilled managers across both domains provides investors with a comprehensive lens to navigate risk, capture opportunity, and sustain long-term growth.

For more than 22 years, The Family Office has specialized in identifying and working with top-tier private market managers worldwide. Our investment approach is built on rigorous due diligence, deep regional expertise, and strong global relationships that give our clients access to opportunities once reserved for institutions.

Today, this expertise is available through our digital ecosystem, where investors can define their goals, explore tailored strategies, and track progress with full transparency. By combining human judgment with technology, we make the process of selecting and monitoring private market managers clear and structured.