While official data may be lacking, there is no shortage of strong opinions. In this article, we tease apart the conflicting views and attempt to shed light on what investors should genuinely be concerned about.

The October Meeting

The usually unanimous Fed has become more fractured in recent months. The latest meeting was no exception, with one committee member voting to hold rates, and another voting to cut rates faster. The Fed also took the significant step of halting its program of Quantitative Tightening (effective as of December 1st), citing emerging pressures in money markets.[2]

The recently published minutes add more texture. While the majority voted to cut rates by a quarter point to the current target range of 3.75% – 4.00%, several would have been happy to hold rates steady.[3] The discussion about the future course of rates revealed a growing divide.[4] The data that is available, while missing for October, explains the reason for this confusion.

What We Know

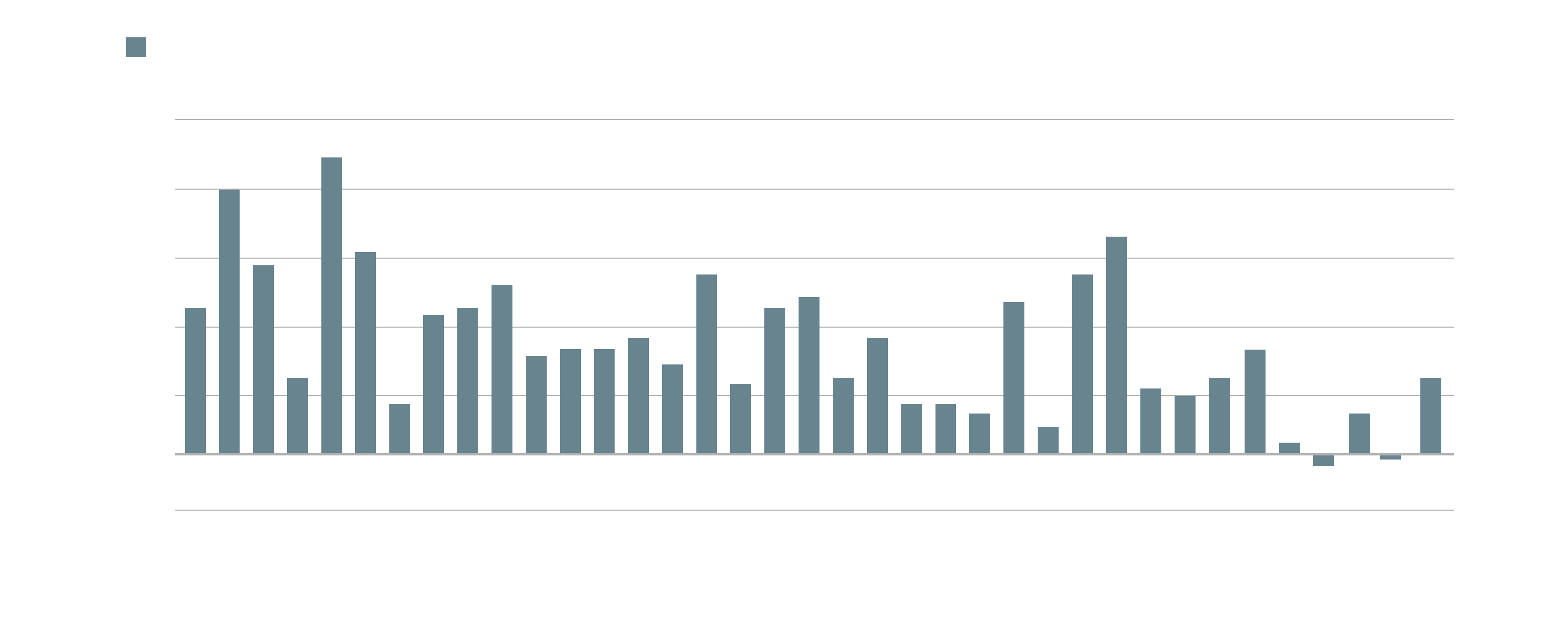

First, let’s consider the employment data. While the latest September figures (+119k) may appear solid, new hires have been on a downward trend every year since 2022, and have seen net losses for the first time this year (in June and August).

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

Safeguarding the job market is one of the Fed’s two explicit mandates. Supporters of further rate cuts will argue that the data above, as well as a rising unemployment rate and rising workforce departures, clearly signal the need for lower rates.

The other side of the equation is, their opponents would argue, stubbornly high inflation.

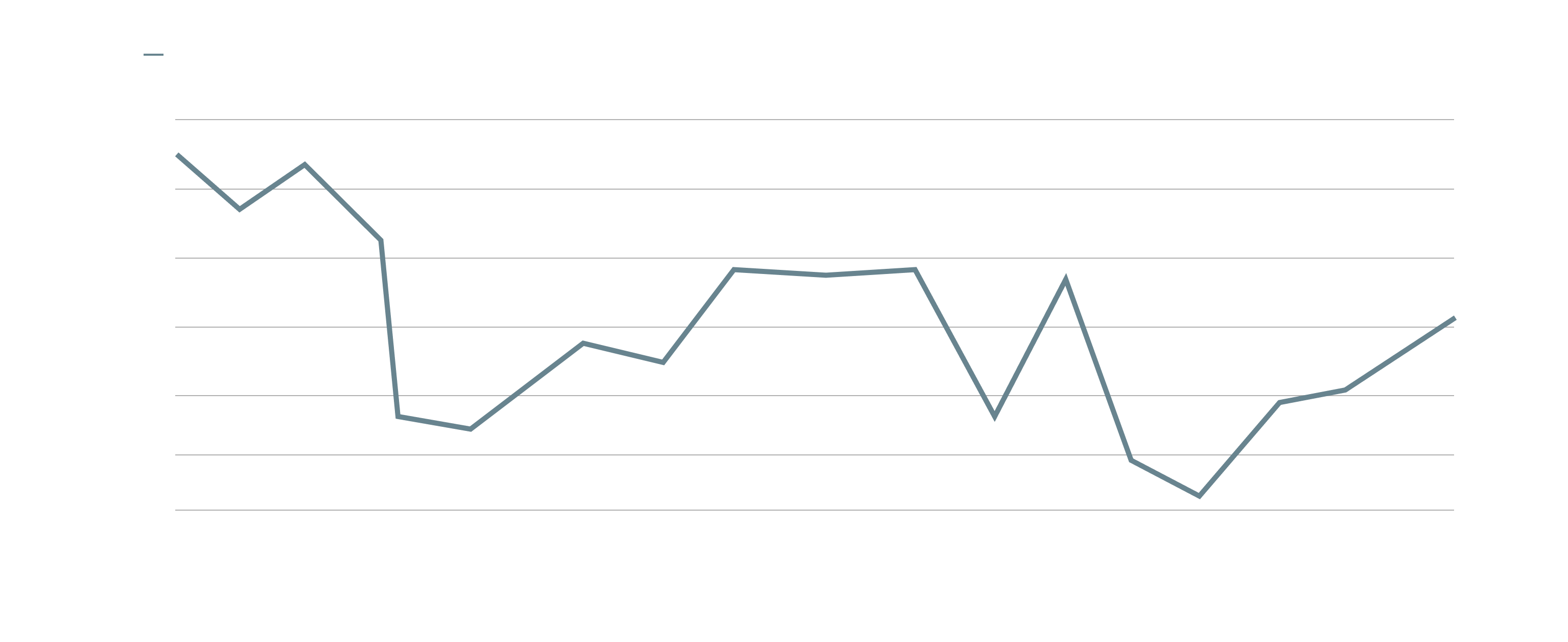

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

Core PCE inflation, which is the Fed’s primary measure of progress, has been creeping back upwards since the April low point of 2.6%. The ‘Nowcast’ from the Federal Reserve Bank of Cleveland suggests that the current level remains around 2.9%, nearly a full percentage point above the target.

This leaves the Fed in a bind, with its two key mandates at odds with one another. The ‘fog’ created by the data gap means that each side must argue its case based on conviction rather than pure facts.

The Ongoing Discussion

Powell’s initial signal to the market was hawkish, or at least highly non-committal, stating that a December cut was not a “foregone conclusion”.[5] Since then, however, statements by colleagues have indicated that the tide of opinion may be turning more in favor of preventing the labor market from deteriorating further.

Futures markets have swung considerably in their expectations.[6] A near consensus on a December cut collapsed to a 50:50 split by the middle of the month, following various hawkish statements by Fed officials (Bostic,[7] Schmid[8]). Subsequent dovish statements (Waller,[9] Williams[10]) have driven expectations of a cut back up to 70% as of the time of writing.

A key argument of the doves is the contention that a material portion of excess inflation is due to tariffs increasing goods prices, which is outside the Fed’s control and - arguably - temporary.

Conclusion

When the decision makers are at odds, what are we, as investors, to make of it all?

The answer is to take a step back and focus on what matters, which is not necessarily the same as what is being discussed. For example, the potential effect of AI as a labor-force productivity booster (i.e., why economic growth is persisting amid a labor slowdown), or whether the liquidity strains in the money market are reasons for broader concern about the financial sector.

Longer-term trends like these are important for long-term returns, which are ultimately the goal of a true investor. The outcome of the next meeting is anyone’s guess, and luckily, of little long-term consequence for an investor’s portfolio.

[7] Federal Reserve Bank of Atlanta