Introduction

Extended forecasts of low GDP growth in the aftermath of the COVID-19 pandemic have prompted sweeping monetary policy intervention worldwide, maintaining low interest rates and expanding central bank balance sheets into non-traditional investment-grade securities in addition to the traditional treasuries and agency mortgage backed securities. Investors seeking income must look beyond traditional sources.

Low Yields are Here to Stay

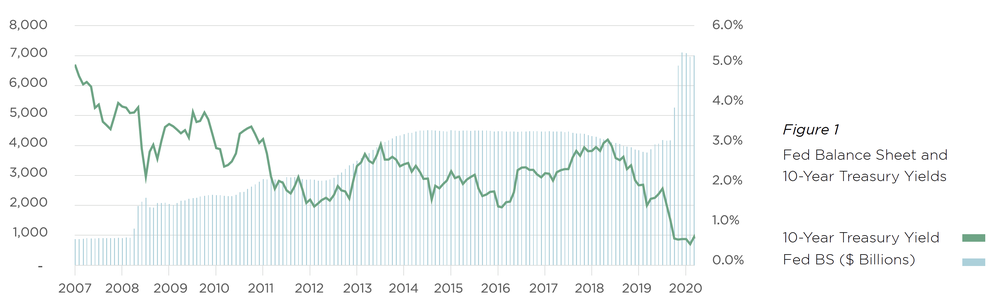

The declining growth in nominal GDP following the Great Financial Crisis impelled massive infusions of liquidity from central bank balance sheets. As benchmark interest rates neared zero, quantitative easing (QE) became the primary tool for central banks to rejuvenate GDP growth.

Those large bond-buying operations were meant to be temporary. However, as the economic recovery became the longest and slowest on record and major economies consistently missed inflation targets, the U.S. Federal Reserve and the European Central Bank continued with more QE.

Sovereign bond yields dropped sharply (see Figures 1 and 2), particularly in Europe where 10-Year German bund yields became negative. The slump in sovereign yields, generally considered risk-free assets, depressed returns across the risk spectrum, reaping capital gains for portfolios but with drastically lower rates of reinvestment.

Figure 3 shows the consistent drop in the yields of fixed income instruments since 2001 across duration and credit risk. The yields of three-month US Treasury bills and high-yield bonds dropped from 3.53% and 12.43%, respectively, in August 2001 to just 0.13% and 6.04%, respectively, by August 2020.

The consistent decline in fixed income yields over the last 20 years has changed the universe of investible assets profoundly for income-seeking investors. In August 2020, the yield of the riskiest benchmark instrument in Figure 3 was less than half of what it was in August 2001, while the safer government bonds provided just a fraction of the income once available. By the end of the 2019 fiscal year, more than US$11.5 trillion of outstanding global debt had negative yields (see Figure 4).

Public Assets no Longer Complement a Portfolio

A portfolio that targets 5% annual distribution in this low-yield environment differs drastically from a decade ago. Figure 5 shows that 62% of the portfolio would have to be allocated to high-yield to achieve a 5% cash yield from January 2014 to January 2020, compared to 11% just 13 years ago (June 2001 to June 2007). The more recent portfolio must double the risk (as measured by weighted standard deviation) to achieve this yield.

Private Assets: The New Norm

To meet return targets and achieve proper diversification in this low-yield environment, investors need alternative assets, especially private markets. Such assets, including private corporate debt and real estate debt, provide attractive risk-adjusted yields with more diversification.

Private corporate debt entails direct loans from nonbank institutions to private companies that are either originated directly or purchased in the secondary market. Private borrowers generally have limited access to bank lending and are willing to pay more for credit, leading to significantly higher returns on private debt than on liquid fixed income. Blackrock estimates five-year returns of 8.7% for global direct lending, compared to 0.2% for U.S. investment-grade credit and 4.9% for U.S. high-yield.

Real estate debt entails privately held loans secured by real estate. Such loans make regular coupon payments and offer more principal protection than real estate private equity, as lenders have a more senior claim than equity investors and are repaid first after a default. Historically, real estate has not been correlated with traditional asset classes, which adds stability to portfolios through diversification. Blackrock estimates five-year returns of 5.8% on mezzanine real estate debt with long-term volatility of 10.7%, compared to returns of 5.2% on for U.S. large cap equities with long-term volatility of 16.3%.

Given the public markets’ dependencies on central bank liquidity, we believe there will be heightened volatility in the public markets. On the other hand, we believe that private markets offer better risk-adjusted returns where the specialization and skillset of the Sponsor is rewarded.

The Family Office combines alternative investment expertise with global sourcing capabilities to serve the income needs of investors. We offer income oriented solutions aimed at preserving capital with diversification across asset classes, sectors, and geographies to help investors achieve their income targets.

We would be delighted to support you in your quest for income.

Disclaimer :

This presentation is provided to you by The Family Office Co. BSC(c) (“The Family Office”) for informational purposes only, and contains proprietary information that may not be reproduced, distributed to, or used by, any third parties without The Family Office’s prior written consent.

All information, figures, calculations, graphs and other numerical representations appearing in this presentation have not been audited and may be subject to change over time. Furthermore, certain valuations (including valuations of investments) appearing in this presentation are subject to change as they may be based on either estimates or historical figures that do not reflect the latest valuation. Although all information and opinions expressed in this presentation were obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to their accuracy or completeness. The information contained herein is not a substitute for a thorough due diligence investigation. Past performance is not indicative of and does not guarantee future performance. Exit timelines, prices and related projections are estimates only, and exits could happen sooner or later than expected, or at a higher or lower valuation than expected, and are conditional, among other things, on certain assumptions and future performance relating to the financial and operational health of each business and macroeconomic conditions.

The Family Office makes no representation or warranty, express or implied, with respect to any statistics or historical or current financial data, whether created by The Family Office through its own research or quoted from other sources. With respect to any such statistics or data delivered or made available by or on behalf of The Family Office, it is acknowledged that (a) the investor takes full responsibility for making its own evaluation of the materiality of the information and the integrity of the quoted source and (b) the investor has no claim against The Family Office.

Amounts in currencies other than the US Dollar are translated using prevailing market rates as calculated by The Family Office or its service providers and may differ from the rates used by banks. The rates are indicative only and do not reflect the rates at which The Family Office would be prepared to enter into any transactions with other parties.

Certain information contained in this presentation constitutes “forward looking statements,” which can be identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “plans,” “estimates,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. To the extent this presentation contains any forecasts, projections, goals, plans and other forward looking statements, such forward looking statements are inherently subject to, known and unknown, significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond The Family Office’s control and may cause actual performance, financial results and other projections in the future to differ materially from any projections of future performance, results or achievements expressed or implied by such forward looking statements. Investors should not place undue reliance on these forward looking statements. The Family Office undertakes no obligation to update any forward looking statements to conform to actual results or changes in The Family Office’s expectations, unless required by applicable law.

The Family Office makes no representation or warranty, express or implied, with respect to any financial projection or forecast With respect to any such projection or forecast delivered or made available by or on behalf of The Family office, it is acknowledged that (a) there are uncertainties inherent in attempting to make such projections and forecasts, (b) the investor is familiar with such uncertainties, (c) the investor takes full responsibility for making its own evaluation of the adequacy and accuracy of all such projections and forecasts so furnished to it and (d) the investor has no claim against The Family Office.

In addition, this presentation does not constitute an offer to sell, or a solicitation to buy, any instrument or other financial product, nor does it amount to a commitment by The Family Office to make such an offer at present or an indication of The Family Office’s willingness to make such an offer in the future.